Stocken Surf Shop began operations on July 1 with an initial investment of ($ 50,000). During the

Question:

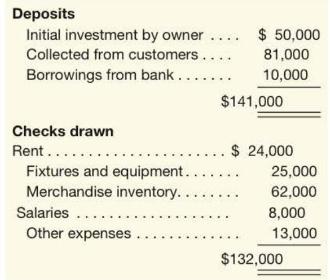

Stocken Surf Shop began operations on July 1 with an initial investment of \(\$ 50,000\). During the first three months of operations, the following cash transactions were recorded in the firm's checking account.

Additional information:

1. Most sales were for cash, however, the store accepted a limited amount of credit sales; at September 30, customers owed the store \(\$ 9,000\).

2. Rent was paid on July 1 for six months.

3. Salaries of \(\$ 4,000\) per month were paid on the 1 st of each month for salaries earned in the month prior.

4. Inventories were purchased for cash; at September 30, inventory of \(\$ 28,000\) was still available.

5. Fixtures and equipment were expected to last five years (or 60 months) with zero salvage value.

6. The bank charges \(12 \%\) annual interest (1\% per month) on the \(\$ 10,000\) bank loan. Stocken took the loan out July 1.

\section*{Required}

a. Record all of Stocken's cash transactions and prepare any necessary adjusting entries at September 30. You may either use the financial statement effects template or journal entries combined with T-accounts.

b. Prepare the income statement for the three months ended September 30, and the balance sheet at September 30 .

c. Analyze the statements from part \(b\) and assess the company's performance over its initial three months.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton