VesPro manufactures motorized scooters in both standard and custom models. The standard scooter is a basic model

Question:

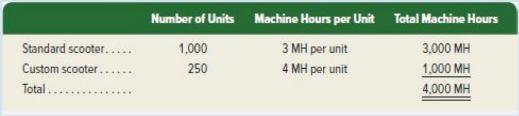

VesPro manufactures motorized scooters in both standard and custom models. The standard scooter is a basic model with no custom options. The custom model is produced for college towns that want scooters with unique logos and color schemes. VesPro budgets \(\$ 300,000\) of overhead cost and 4,000 machine hours (MH) for the year. VesPro reports the following actual production information.

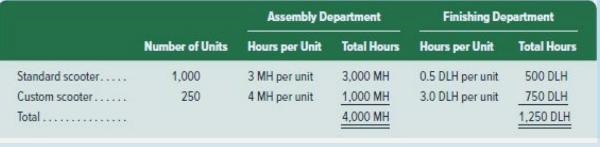

VesPro is considering the departmental rate method and traces \(\$ 240,000\) of overhead cost to its Assembly department and \(\$ 60,000\) to its Finishing department. The company budgets 4,000 machine hours in the Assembly department and budgets 1,250 direct labor hours (DLH) in the Finishing department. Actual production information for the two departments follows.

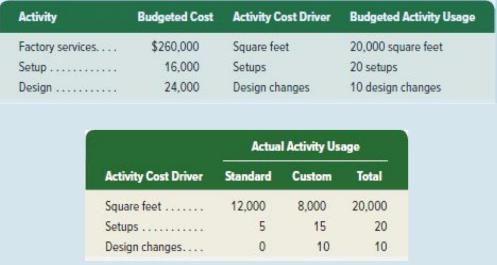

VesPro is also considering activity-based costing and collects page 682 information in the following two tables.

Required

1. Compute overhead cost per unit for each type of scooter using a plantwide overhead rate based on machine hours.

2. Compute overhead cost per unit for each type of scooter using departmental overhead rates based on machine hours for the Assembly department and direct labor hours for the Finishing department.

3. Compute overhead cost per unit for each type of scooter using activity-based costing.

4. Prepare a summary table that reports the overhead cost per unit for both scooter types under each alternative allocation method from parts 1,2 , and 3 .

5. VesPro reports the following additional information. Assuming the company uses activity-based costing,

(a) compute product cost per unit

(b) compute gross profit per unit (selling price per unit minus product cost per unit).

Step by Step Answer: