YUM! Brands, Inc., reports the following footnote relating to its capital and operating leases in its 2012

Question:

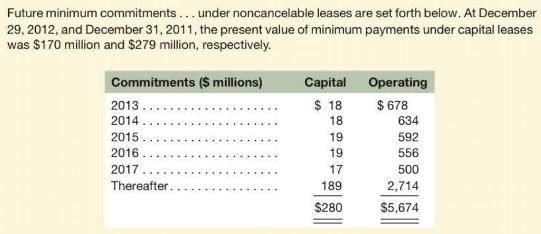

YUM! Brands, Inc., reports the following footnote relating to its capital and operating leases in its 2012 \(10-\mathrm{K}\) report ( \(\$\) millions).

a. Confirm that the implicit rate on YUM!'s capital leases is 6.66\%. Using a 6.66\% discount rate, compute the present value of YUM!'s operating leases and rounding the remaining lease life to three decimal places. Describe the adjustments we might consider to YUM!'s balance sheet and income statement using that information.

b. YUM! reported total liabilities of \(\$ 6,699\) million for 2012 . Would the adjustment from part \(a\) make a substantial difference to YUM!'s total liabilities? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted: