1. Identify the appropriate accounting method for each of the following situations a. Investment in 25% of...

Question:

1. Identify the appropriate accounting method for each of the following situations

a. Investment in 25% of the investee company’s stock of which the investor has significant influence

b. Available-for-sale debt investment

c. Investment in more than 50% of the investee company’s stock

d. Bond investment that matures in four years. The investor plans to hold the bond for the full four years.

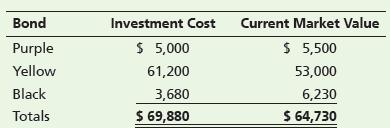

2. At what amount should the following trading debt investment portfolio be reported on the December 31, 2024, balance sheet?

Journalize any adjusting entry required on December 31.

3. An investor paid $67,900 on January 1, 2024, to acquire 40% of Finn-Girl, Inc.’s outstanding common stock. The investor had significant influence of Finn-Girl, Inc.

For the year ending December 31, 2024, Finn-Girl’s net income was $80,000, and on June 14, the company declared and paid cash dividends of $55,000 to all stockholders.

Journalize the investor’s transactions related to the Finn-Girl investment:

(a) purchase of the investment,

(b) receipt of dividends,

(c) investor’s share of net income, and

(d) sale of Finn-Girl stock for $80,100 on January 3, 2025.

Step by Step Answer:

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9781292412320

7th Global Edition

Authors: Tracie Miller-Nobles, Brenda Mattison, Ella Mae Matsumura