Problem P-F:2-41 continues with the company introduced in Chapter F:1, Canyon Canoe Company. Here you will account

Question:

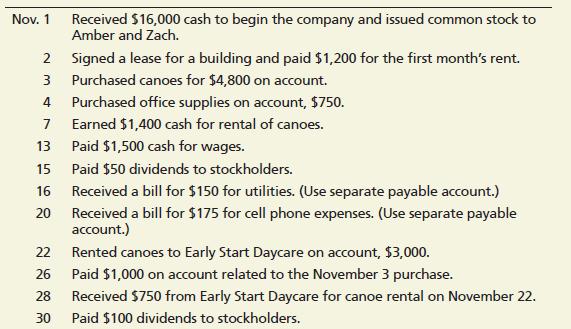

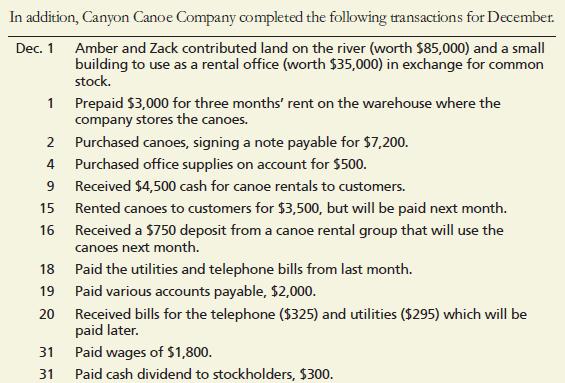

Problem P-F:2-41 continues with the company introduced in Chapter F:1, Canyon Canoe Company. Here you will account for Canyon Canoe Company’s transactions as it is actually done in practice. Begin by reviewing the transactions from Chapter F:1.

The transactions have been reprinted below.

Requirements

1. Journalize the transactions for both November and December, using the following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Rent; Land;

Building; Canoes; Accounts Payable; Utilities Payable; Telephone Payable;

Unearned Revenue; Notes Payable; Common Stock; Dividends; Canoe Rental Revenue; Rent Expense; Utilities Expense; Wages Expense; and Telephone Expense. Explanations are not required. (Hint: For November transactions, refer to your answer for Chapter F:1.)

2. Open a T-account for each of the accounts.

3. Post the journal entries to the T-accounts and calculate account balances. Formal posting references are not required.

4. Prepare a trial balance as of December 31, 2024.

5. Prepare the income statement of Canyon Canoe Company for the two months ended December 31, 2024.

6. Prepare the statement of retained earnings for the two months ended December 31, 2024.

7. Prepare the balance sheet as of December 31, 2024.

8. Calculate the debt ratio for Canyon Canoe Company at December 31, 2024.

Step by Step Answer:

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9781292412320

7th Global Edition

Authors: Tracie Miller-Nobles, Brenda Mattison, Ella Mae Matsumura