The Radiology Department at St. Josephs Hospital, a not-for-profit, is considering purchasing a magnetic resonance imaging (MRI)

Question:

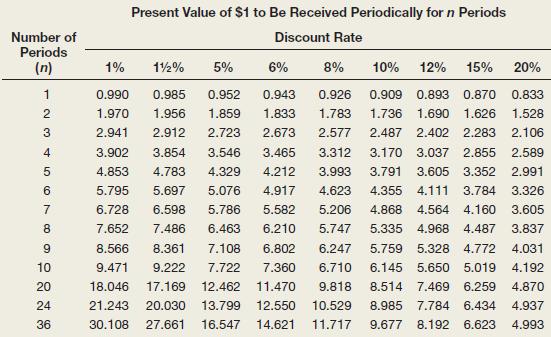

The Radiology Department at St. Joseph’s Hospital, a not-for-profit, is considering purchasing a magnetic resonance imaging (MRI) machine. The cost to purchase and install an MRI is approximately $2,500,000. Assume St. Joseph’s would like a minimum 8 percent return and that the economic life of the MRI is expected to be 10 years, with no salvage value. Assume that if the MRI is installed, the net cash flows are expected to increase by $375,000 per year. Use Exhibit 26–4 for present value factors.

a. Find the NPV of the MRI.

b. Should the hospital acquire the MRI?

c. What nonfinancial considerations might be important to the MRI investment decision?

Exhibit 26-4:

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078025778

17th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello