This problem continues the Canyon Canoe Company situation from Chapter F:12. After looking into debt financing through

Question:

This problem continues the Canyon Canoe Company situation from Chapter F:12.

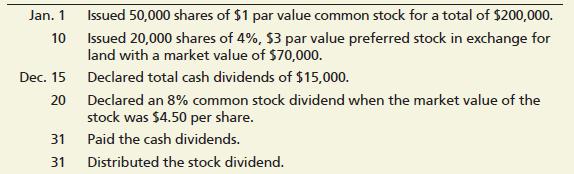

After looking into debt financing through notes, mortgage, and bonds payable, Canyon Canoe Company decides to raise additional capital for the planned business expansion. The company will be able to acquire cash as well as land adjacent to its current business location. Before the following transactions, the balance in Common Stock on January 1, 2027, was $136,000 and included 136,000 shares of common stock issued and outstanding. (There was no Paid-In Capital in Excess of Par—Common.)

Canyon Canoe Company had the following transactions in 2027

Requirements

1. Journalize the transactions.

2. Calculate the balance in Retained Earnings on December 31, 2027. Assume the balance on January 1, 2027, was $4,250 and net income for the year was $417,000.

3. Prepare the stockholders’ equity section of the balance sheet as of December 31, 2027. There was no preferred stock issued prior to the 2027 transactions.

Step by Step Answer:

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9781292412320

7th Global Edition

Authors: Tracie Miller-Nobles, Brenda Mattison, Ella Mae Matsumura