Question: A business is evaluating three competing projects whose profits are shown below. All three involve investment in a machine that is expected to have no

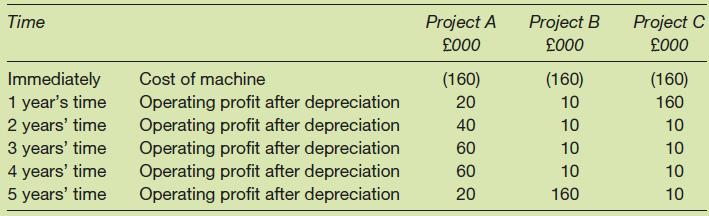

A business is evaluating three competing projects whose profits are shown below. All three involve investment in a machine that is expected to have no residual value at the end of the five years. Note that all the projects have the same total operating profits after depreciation over the five years.

What defect in the ARR method would prevent it from distinguishing between these competing projects?

Time Immediately 1 year's time 2 years' time 3 years' time 4 years' time 5 years' time Cost of machine Operating profit after depreciation Operating profit after depreciation Operating profit after depreciation Operating profit after depreciation Operating profit after depreciation Project A 000 (160) 20 40 60 60 20 Project B 000 (160) 10 10 10 10 160 Project C 000 (160) 160 10 10 10 10

Step by Step Solution

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts