Can you work out the EVA for the second year of Scorpio plc in Example 11.3? Example

Question:

Can you work out the EVA® for the second year of Scorpio plc in Example 11.3?

Example 11.3

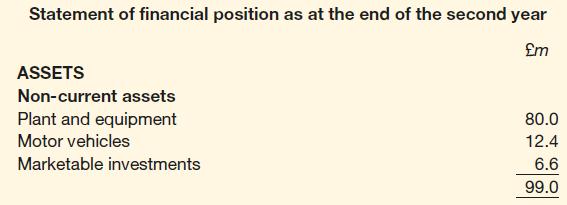

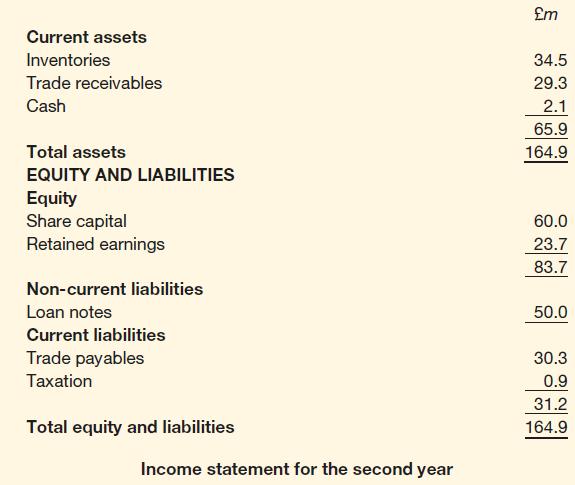

Scorpio plc was established two years ago and has produced the following statement of financial position and income statement at the end of the second year of trading.

Discussions with the chief financial officer reveal the following:

1 Marketing costs relate to the launch of a new product. The benefits of the marketing campaign are expected to last for three years (including this most recent year).

2 The allowance for trade receivables was created this year and the amount is considered to be very high. A more realistic figure for the allowance would be £2.0 million.

3 Restructuring costs were incurred as a result of a collapse in a particular product market.

As a result of the restructuring, benefits are expected to flow for an infinite period.

4 The business has a 10 per cent required rate of return for investors.

5 The rate of tax on profits is 25 per cent.

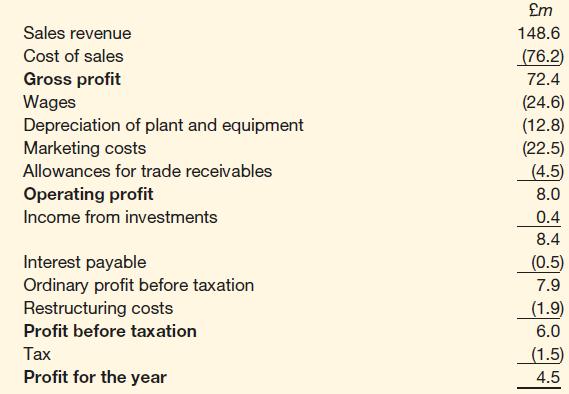

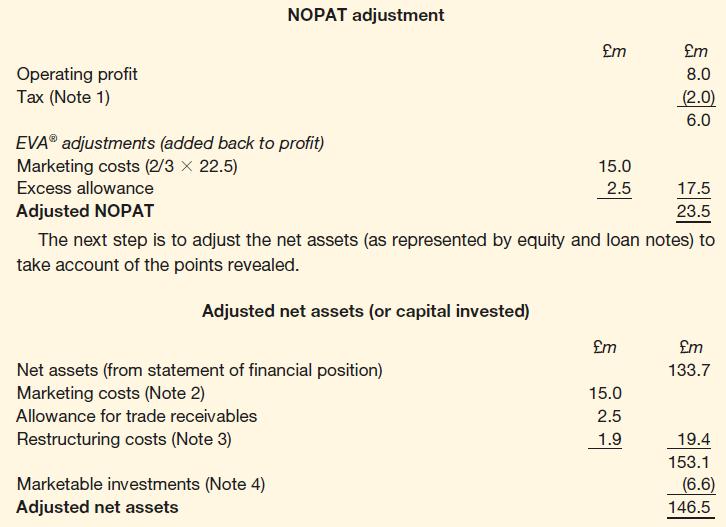

6 The capital invested at the end of the year fairly reflects the average capital invested during the year. The first step in calculating EVA® is to adjust the net operating profit after tax to take account of the various points revealed from the discussion with the chief financial officer.

The revised figure is calculated as follows:

Step by Step Answer: