Fowler Ltd produces Vitex, a vitamin supplement drink that is sold for 1.20 per bottle. At present

Question:

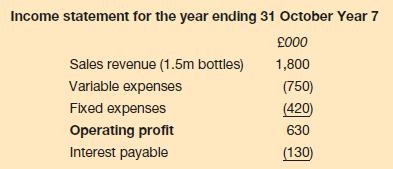

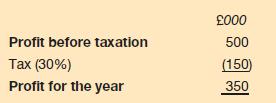

Fowler Ltd produces ‘Vitex’, a vitamin supplement drink that is sold for £1.20 per bottle. At present the business’s bottling plant is operating at full capacity and it is not possible to expand sales beyond the current level unless there is further investment in plant and machinery. The most recent income statement for the business is as follows:

The statement of financial position of the business revealed that 2 million £1 ordinary shares are in issue as well as 10 per cent loan notes with a nominal value of £1.3 million. There are no reserves as all profits have been distributed as dividends.

It is believed that output can be increased by 20 per cent if the existing bottling line was replaced. The cost of the new line would be £2 million, which could be financed by the issue of 10 per cent loan notes at £80 per £100 nominal value. The new bottling line would reduce variable costs by £0.15 per bottle but would increase fixed costs by £150,000 per year. Installation of the new line can occur immediately after a decision is made.

Required:

Assume that the business decides to install the bottling line at the beginning of Year 8 and all the increased output can be sold.

(a) Prepare a projected income statement for the year to 31 October Year 8.

(b) Calculate for Year 7 and Year 8 the:

(i) Earnings per share

(ii) Degree of operating gearing

(iii) Degree of financial gearing

(iv) Degree of combined gearing.

(c) Briefly evaluate the information produced in your answers to Parts (a) and (b) above.

(d) Calculate the sales revenue required in Year 8 to maintain existing earnings per share.

Step by Step Answer: