Hackney Wholesalers plc is about to embark on an expansion programme that will have a significant impact

Question:

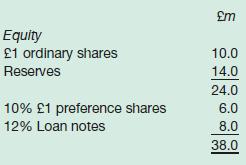

Hackney Wholesalers plc is about to embark on an expansion programme that will have a significant impact on the size and nature of the business in forthcoming years. As at 31 July Year 6, the business has the following capital structure:

The ordinary shares have a current market value of £2.80 and the current dividend is £0.16 per share. Dividends are expected to increase by a compound rate of 5 per cent per year for the indefinite future. The preference shares are irredeemable and have a current market value of £1.20 per share. The loan notes are also irredeemable and have a current market value of £125 per £100 nominal. The business has decided that any new finance will be raised in line with the target capital structure of 50 per cent ordinary shares, 20 per cent preference shares and 30 per cent loan notes.

The rate of corporation tax is 20 per cent.

Required:

(a) Calculate the weighted average cost of capital of the business based on the optimal financing mix. (Work to two decimal places.)

(b) Explain the advantages and disadvantages of a business having loan capital as part of its capital structure.

Step by Step Answer: