It is now March, and the current cost of debt for Wansley Construction is 12%. Wansley plans

Question:

It is now March, and the current cost of debt for Wansley Construction is 12%. Wansley plans to issue $5 million in 20-year bonds (with coupons paid semiannually) in September, but is afraid that rates will climb even higher before then. The following data are available:

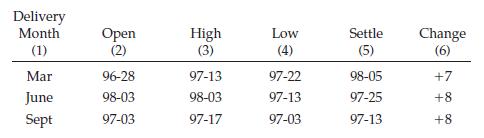

Futures Prices: Treasury Bonds—$100,000; Pts. 32nds of 100%

a. What is the implied interest rate on the September contract?

b. Construct a hedge for Wansley.

c. Assume all interest rates rise by 1 percentage point. What is the dollar value of Wansley’s increased cost of issuing debt? What is Wansley’s gain from the futures contract?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt

Question Posted: