Question: Recommend a solution for Unicorn Engineering Ltd in Example5.1 above if the investment projects were not divisible (that is, it was not possible to undertake

Recommend a solution for Unicorn Engineering Ltd in Example5.1 above if the investment projects were not divisible (that is, it was not possible to undertake part of a project).

Assume the finance available was:

(a) £12 million

(b) £18 million

(c) £20 million.

Data from Example5.1

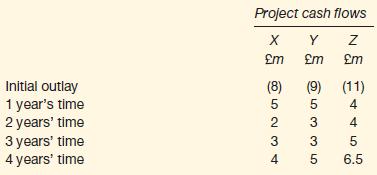

Unicorn Engineering Ltd is considering three possible investment projects: X, Y and Z. The expected pattern of cash flows for each project is as follows:

The business has a cost of capital of 12 per cent and the investment budget for the year that has just begun is restricted to £12 million. Each project is divisible (that is, it is possible to undertake part of a project if required).

Initial outlay 1 year's time 2 years' time 3 years' time 4 years' time Project cash flows X Y Z m m m (8) 5 2 34 (9) 5 3 3 5 (11) 4 4 5 6.5

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

If the capital available was 12 million only Project Z should be recommended as thi... View full answer

Get step-by-step solutions from verified subject matter experts