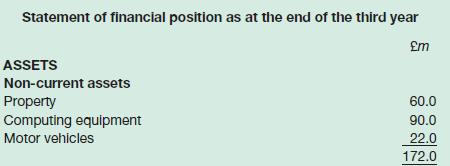

Romeo plc produced the following statement of financial position at the end of the third year of

Question:

Romeo plc produced the following statement of financial position at the end of the third year of trading:

An analysis of the underlying records reveals the following:

1. R&D costs relating to the development of a new product in the current year had been written off at a cost of £10 million. However, this is a prudent approach and the benefits are expected to last for ten years.

2. Property has a current value of £200 million.

3. The current market value of an ordinary share is £8.50.

4. The book value of the loan notes reflects their current market value.

Required:

Calculate the MVA for the business over its period of trading.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: