Telford Engineers plc, a medium-sized manufacturer of automobile components, has decided to modernise its factory by introducing

Question:

Telford Engineers plc, a medium-sized manufacturer of automobile components, has decided to modernise its factory by introducing a number of robots. These will cost £20million and will reduce operating costs by £6 million a year for their estimated useful life of 10 years starting next year (Year 10). To finance this scheme, the business can raise £20 million either by issuing:

(i) 20 million ordinary shares at 100p, or

(ii) loan notes at 7 per cent interest a year with capital repayments of £3 million a year commencing at the end of Year 11.

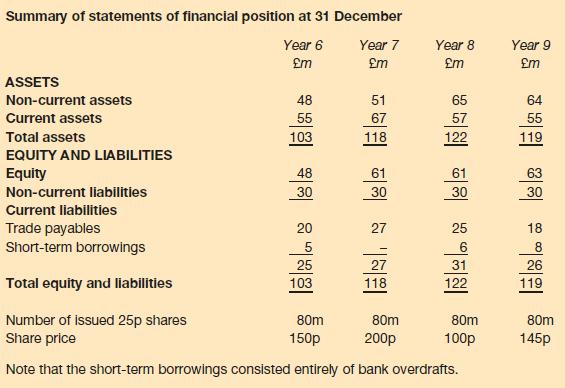

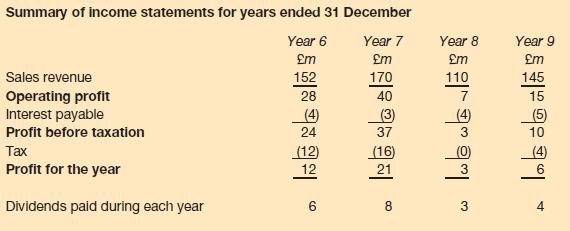

Telford Engineers’ summarised financial statements appear below.

You should assume that the tax rate for Year 10 is 30 per cent, that sales revenue and operating profit will be unchanged except for the £6 million cost saving arising from the introduction of the robots, and that Telford Engineers will pay the same dividend per share in Year 10 as in Year 9.

Required:

(a) Prepare, for each financing arrangement, Telford Engineers’ projected income statement for the year ending 31 December Year 10 and a statement of its share capital, reserves and loans on that date.

(b) Calculate Telford’s projected earnings per share for Year 10 for both schemes.

(c) Which scheme would you advise the business to adopt? You should give your reasons and state what additional information you would require.

Step by Step Answer: