The senior management of Galbraith Ltd is negotiating a management buyout of the business from the existing

Question:

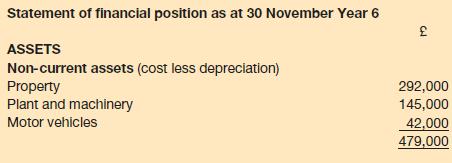

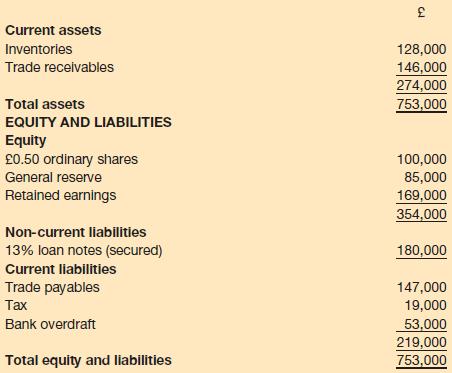

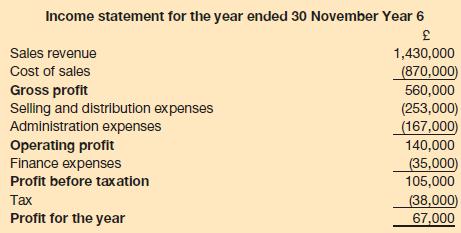

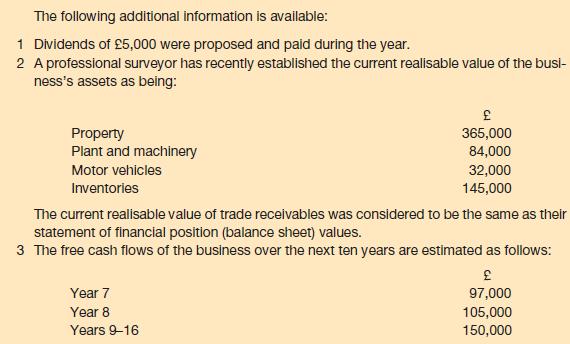

The senior management of Galbraith Ltd is negotiating a management buyout of the business from the existing shareholders. The most recent financial statements of Galbraith Ltd are as follows:

Required:

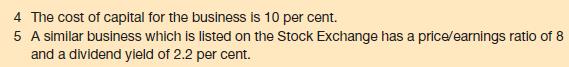

(a) Calculate the value of a share in Galbraith Ltd using the following valuation methods:

(i) net assets (liquidation) basis

(ii) price/earnings ratio basis

(iii) dividend yield ratio basis

(iv) free cash flow basis (assuming a ten-year life for the business).

(b) Briefly evaluate each of the share valuation methods set out in (a).

(c) Which share valuation method, if any, do you consider most appropriate as a basis for negotiation and why?

(d) What potential problems will a management buyout proposal pose for the shareholders of Galbraith Ltd?

Step by Step Answer: