Question: Why is PP not a complete answer to the problem of assessing investment opportunities? Consider the cash flows arising from three competing projects: Time Immediately

Why is PP not a complete answer to the problem of assessing investment opportunities?

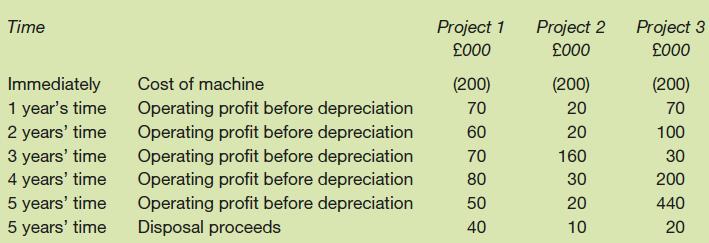

Consider the cash flows arising from three competing projects:

Time Immediately 1 year's time 2 years' time 3 years' time 4 years' time 5 years' time 5 years' time Cost of machine Operating profit before depreciation Operating profit before depreciation Operating profit before depreciation Operating profit before depreciation Operating profit before depreciation Disposal proceeds Project 1 000 (200) 70 60 70 80 50 40 Project 2 000 (200) 20 20 160 30 20 10 Project 3 000 (200) 70 100 30 200 440 20

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

You are right PP or operating profit before depreciation is not a complete answer to the problem of ... View full answer

Get step-by-step solutions from verified subject matter experts