Assume that you are Cochran's assistant and that you must help her answer the following questions for

Question:

Assume that you are Cochran's assistant and that you must help her answer the following questions for Meissner.

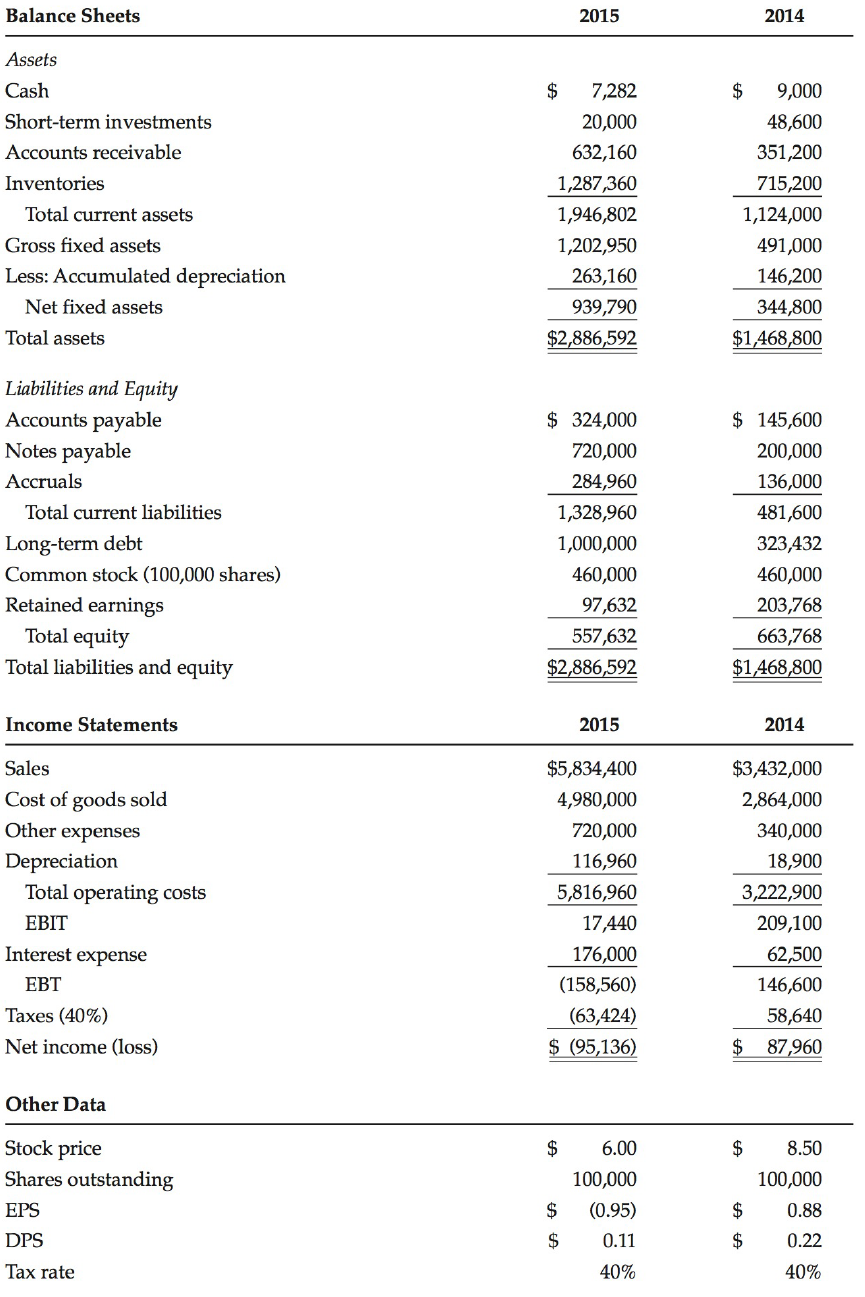

a. What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the balance sheet? What effect did it have on liabilities and equity?

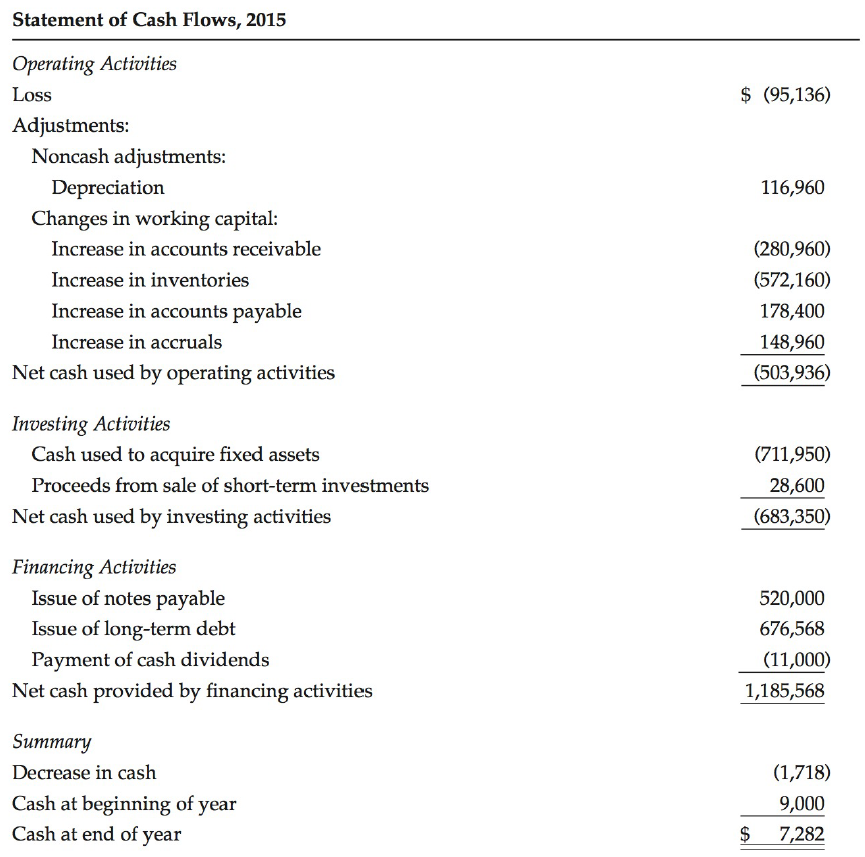

b. What do you conclude from the statement of cash flows?

c. What is free cash flow? Why is it important? What are the five uses of FCF?

d. What is Computron's net operating profit (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have?

e. What is Computron's free cash flow (FCF)? What are Computron's "net uses" of its FCF?

f. Calculate Computron's return on invested capital. Computron has a 10% cost of capital (WACC). Do you think Computron's growth added value?

g. Cochran also has asked you to estimate Computron's EVA. She estimates that the after-tax cost of capital was 10% in both years.

h. What happened to Computron's Market Value Added (MVA)?

i. Given that Computron could have issued preferred shares yielding 6% net of costs, why did the company decide to borrow more from the bank at a rate of 7.5%?

Jenny Cochran a graduate of the University of Ottawa with 4 years of banking experience, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components.

The company doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Computron's results were not satisfactory, to put it mildly. Its board of directors, which consisted of its president and vice president plus its major shareholders (who were all local business people), was most upset when directors learned how the expansion was going. Suppliers were being paid late and were unhappy, and the bank was complaining about the deteriorating situation and threatening to cut off credit. As a result, AI Watkins, Computron's president, was informed that changes would have to be made, and quickly, or he would be fired. Also, at the board's insistence, Jenny Cochran was brought in and given the job of assistant to Gary Meissner, a retired banker who was Computron's chairman and largest shareholder. Meissner agreed to give up a few of his golfing days and to help nurse the company back to health, with Cochran's help.

Cochran began by gathering financial statements and other data. Note: these are available in the file Ch02 Tool kit.xlsx.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason