Citrus Products Inc. is a medium-sized producer of citrus juice drinks with groves in Indian River County,

Question:

Citrus Products Inc. is a medium-sized producer of citrus juice drinks with groves in Indian River County, Florida. Until now, the company has confined its operations and sales to the United States, but its CEO, George Gaynor, wants to expand into Europe. The first step would be to set up sales subsidiaries in Spain and Sweden, then to set up a production plant in Spain, and finally to distribute the product throughout the European common market. The firm’s financial manager, Ruth Schmidt, is enthusiastic about the plan, but she is worried about the implications of the foreign expansion on the firm’s financial management process. She has asked you, the firm’s most recently hired financial analyst, to develop a 1-hour tutorial package that explains the basics of multinational financial management. The tutorial will be presented at the next board of directors’ meeting. To get you started, Schmidt has supplied you with the following list of questions.

a. What is a multinational corporation? Why do firms expand into other countries?

b. What are the six major factors that distinguish multinational financial management from financial management as practiced by a purely domestic firm?

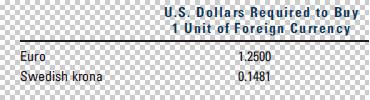

c. Consider the following illustrative exchange rates.

(1) Are these currency prices direct quotations or indirect quotations?

(2) Calculate the indirect quotations for euros and kronor (the plural of krona is kronor).

(3) What is a cross rate? Calculate the two cross rates between euros and kronor.

(4) Assume Citrus Products can produce a liter of orange juice and ship it to Spain for $1.75. If the firm wants a 50% markup on the product, what should the orange juice sell for in Spain?

(5) Now assume that Citrus Products begins producing the same liter of orange juice in Spain. The product costs 2 euros to produce and ship to Sweden, where it can be sold for 20 kronor. What is the dollar profit on the sale?

(6) What is exchange rate risk?

d. Briefly describe the current international monetary system. How does the current system differ from the system that was in place prior to August 1971?

e. What is a convertible currency? What problems arise when a multinational company operates in a country whose currency is not convertible?

f. What is the difference between spot rates and forward rates? When is the forward rate at a premium to the spot rate? At a discount?

g. What is interest rate parity? Currently, you can exchange 1 euro for 1.27 dollars in the 180-day forward market, and the risk-free rate on 180-day securities is 6% in the United States and 4% in Spain. Does interest rate parity hold? If not, which securities offer the highest expected return?

h. What is purchasing power parity? If grapefruit juice costs $2 a liter in the United States and purchasing power parity holds, what should be the price of grapefruit juice in Spain?

i. What effect does relative inflation have on interest rates and exchange rates?

j. Briefly discuss the international capital markets.

k. To what extent do average capital structures vary across different countries?

l. Briefly describe special problems that occur in multinational capital budgeting, and describe the process for evaluating a foreign project. Now consider the following project: A U.S. company has the opportunity to lease a manufacturing facility in Japan for 2 years. The company must spend ¥1 billion initially to refurbish the plant. The expected net cash flows from the plant for the next 2 years, in millions, are CF1 = ¥500 and CF2 = ¥800. A similar project in the United States would have a risk-adjusted cost of capital of 10%. In the United States, a 1-year government bond pays 2% interest and a 2-year bond pays 2.8%. In Japan, a 1-year bond pays 0.05% and a 2-year bond pays 0.26%. What is the project’s NPV?

m. Briefly discuss special factors associated with the following areas of multinational working capital management:

(1) Cash management

(2) Credit management

(3) Inventory management

Step by Step Answer:

Financial management theory and practice

ISBN: 978-1439078099

13th edition

Authors: Eugene F. Brigham and Michael C. Ehrhardt