Richter Manufacturing has a 10% unlevered cost of equity. Richter forecasts the following free cash flows (FCFs),

Question:

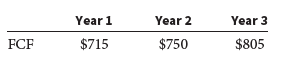

Richter Manufacturing has a 10% unlevered cost of equity. Richter forecasts the following free cash flows (FCFs), which are expected to grow at a constant 3% rate after Year 3.

a. What is the horizon value of the unlevered operations?

b. What is the total value of unlevered operations at Year 0?

Transcribed Image Text:

Year 2 Year 1 Year 3 $715 $805 $750 FCF

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Year 1 Year 2 Year 3 FCF 715 750 805 a Unle...View the full answer

Answered By

Nyron Beeput

I am an active educator and professional tutor with substantial experience in Biology and General Science. The past two years I have been tutoring online intensively with high school and college students. I have been teaching for four years and this experience has helped me to hone skills such as patience, dedication and flexibility. I work at the pace of my students and ensure that they understand.

My method of using real life examples that my students can relate to has helped them grasp concepts more readily. I also help students learn how to apply their knowledge and they appreciate that very much.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial Management Theory and Practice

ISBN: 978-1337902601

16th edition

Authors: Eugene F. Brigham, Michael C. Ehrhardt

Question Posted:

Students also viewed these Business questions

-

Wilde Software Development has a 12% unlevered cost of equity. Wilde forecasts the following interest expenses, which are expected to grow at a constant 4% rate after Year 3. Wilde?s tax rate is 25%....

-

Sheldon Corporation projects the following free cash flows (FCFs) and interest expenses for the next 3 years, after which FCF and interest expenses are expected to grow at a constant 7% rate....

-

Crane Rafting Corporation is considering an acquisition of Frost Ski Supplies. Frost has a pre-merger 8% unlevered cost of equity, 6% pre-tax cost of debt, and 25% tax rate. Its pre-merger forecasted...

-

33. Monker Dining Room Furniture manufactures two models of dining table sets: Traditional brand Contemporary. Manufacturing requirements are as follows: um boxi mod sq to get YTO TRADITIONAL...

-

What feature of DNA replication, as shown in Figure, is inconsistent with the known enzymatic properties of DNA polymerases? What observation reconciled this inconsistency? Motion of replication fork...

-

According to KST Electric, when is a mark a famous mark?

-

List three ways to get input from the console and convert that input to the desired data type.

-

Managers at Wagner Fabricating Company are reviewing the economic feasibility of manufacturing a part that it currently purchases from a supplier. Forecasted annual demand for the part is 3200 units....

-

A function and its graph are given. Find the domain. (Enter your answer using interval notation.) f(x) x-5 = X-8 (-0,8) U (8,00) y 10 K 5 -5 -10 X 2 4 8 10 12

-

A ride hailing company has their DB structured in 3 major tables as described in the SCHEMA section below. Write a query to fetch the top 100 users who traveled the most distance using the service....

-

Access CPA Canadas CAS 720, Auditors responsibilities relating to other information, to answer the following questions: a. What is the definition of other information? b. List some examples of other...

-

Elliotts Cross Country Transportation Services has a capital structure with 25% debt at a 9% interest rate. Its beta is 1.6, the risk-free rate is 4%, and the market risk premium is 7%. Elliotts...

-

Why do you think the wave aspect of light was discovered earlier than its particle aspect?

-

Write the ratio of mixed numbers in simplest terms: 3 2 6 to 54 6 Be sure to write your answer as a reduced fraction (e.g., 12/7). Submit Question

-

What would be the Marketing Plan Implementation, Evaluation, and Control List for Perdue Farms. Develop the strategy for the Perdue Farms. Discuss what sales elements are needed for your...

-

Marketing researchers often need to estimate the market potential of a product. Market potential is the maximum sales of a product category reasonably attainable under a given set of conditions...

-

EEC uses debt and common equity. It can borrow unlimited amount at rd = 9.5% as long as it finances at its target capital structure - 30% debt and 70% common equity. Its last common stock dividend...

-

Proposed digital marketing strategy that takes into account the Cape Union Mart current brand and e-commerce strategy and aligned with the case study "Cape union mart: digital transformation and...

-

Jonczyk Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $395,000, has an expected useful life of 10 years, a salvage value of zero, and is...

-

Arlington Merchants reported the following on its income statement for the fiscal years ending December 31, 2016 and 2015. 2016 2015 Sales $4,857,500 $4,752,900 Cost of goods sold 3,258,950 3,207,000...

-

EMC Corporation has never paid a dividend. Its current free cash flow is $400,000 and is expected to grow at a constant rate of 5 percent. The weighted average cost of capital is WACC _ 12%....

-

Give two reasons stockholders might be indifferent between owning the stock of a firm with volatile cash flows and that of a firm with stable cash flows.

-

Give two reasons stockholders might be indifferent between owning the stock of a firm with volatile cash flows and that of a firm with stable cash flows.

-

A bond has a coupon rate of 1 0 . 5 % and pays coupons annually. The bond matures in 9 years and the yield to maturity on similar bonds is 9 . 4 % . What is the price of the bond?

-

A 1 5 - year, 1 4 % semiannual coupon bond with a par value of $ 1 , 0 0 0 may be called in 4 years at a call price of $ 1 , 0 7 5 . The bond sells for $ 1 , 0 5 0 . ( Assume that the bond has just...

-

A particle has its position as a function of time given by; (t) = 3.33m cos (0.95t+0.58) + 3.33m sin(0.95-t + 0.58) +5.82tk (The input below will accept answers with no more than 1% variation from...

Study smarter with the SolutionInn App