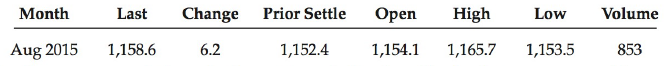

The following are data on August 2015 gold futures contracts: A mining company wishes to hedge against

Question:

The following are data on August 2015 gold futures contracts:

A mining company wishes to hedge against a decline in gold prices between now and August. The company has 2,500 oz. of gold to hedge (each futures contract is based on 100 oz.).

a. If gold prices decline by $0.25 per oz., what is the change in value of 1 contract?

b. How should the company hedge itself? What will be the value of the total futures position?

c. If closing prices for the next four days are 1,158.6; 1,176.1; 1,183.0 and 1,172.0, what are the losses and profits each day for the company? What was the company's net gain (loss) over the 4 days?

d. If the futures contract matured in August at 1,161.7, how much did the company gain or lose by hedging?

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason