Question: Computing dividends on preferred and common stock and journalizing The following elements of stockholders equity are from the balance sheet of Sneed Marketing Corp. at

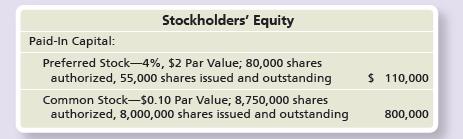

Computing dividends on preferred and common stock and journalizing The following elements of stockholders’ equity are from the balance sheet of Sneed Marketing Corp. at December 31, 2017:

Sneed paid no preferred dividends in 2017.

Requirements 1. Compute the dividends to the preferred and common shareholders for 2018 if total dividends are $185,000 and assuming the preferred stock is noncumulative.

Assume no changes in preferred and common stock in 2018.

2. Record the journal entries for 2018 assuming that Sneed Marketing Corp. declared the dividends on July 1 for stockholders of record on July 15. Sneed paid the dividends on July 31.

Paid-In Capital: Stockholders' Equity Preferred Stock-4%, $2 Par Value; 80,000 shares authorized, 55,000 shares issued and outstanding Common Stock-$0.10 Par Value; 8,750,000 shares authorized, 8,000,000 shares issued and outstanding $ 110,000 800,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts