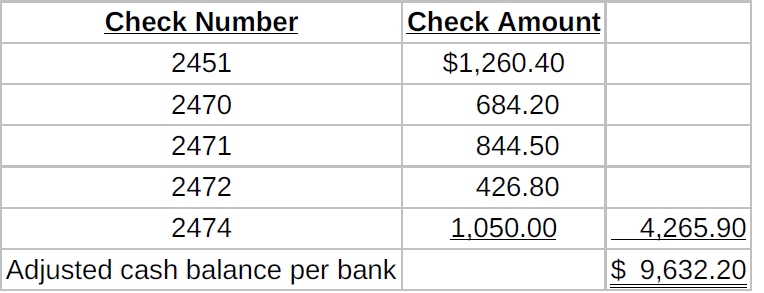

The bank portion of the bank reconciliation for Bogalusa Company at October 31, 2020, is shown below.

Question:

The bank portion of the bank reconciliation for Bogalusa Company at October 31, 2020, is shown below.

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ??Bogalusa Company? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?Bank Reconciliation? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? October 31, 2020Cash balance per bank ........................ $12,367.90Add: Deposits in transit .......................?? ? 1,530.20? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?13,898.10Less: Outstanding checks

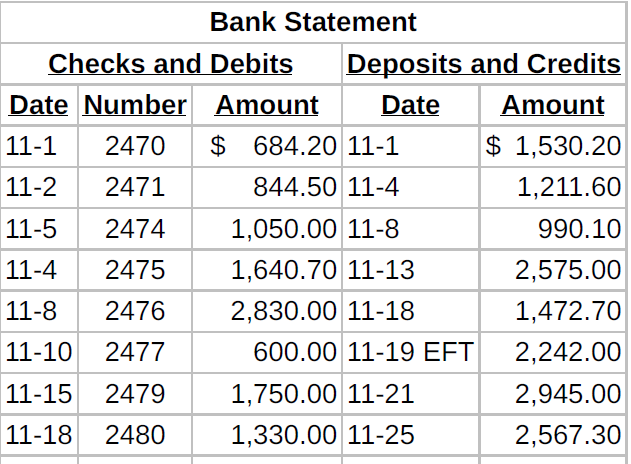

The adjusted cash balance per bank agreed with the cash balance per books at October 31. The November bank statement showed the following checks and deposits.

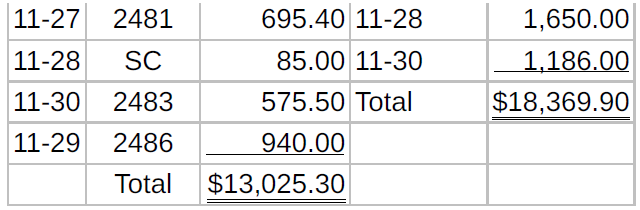

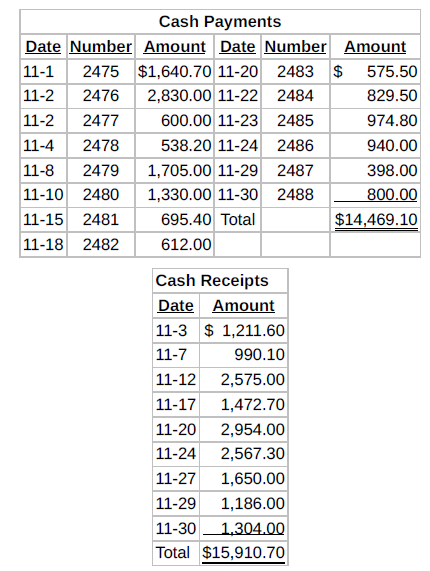

The cash records per books for November showed the following.

The bank statement contained two bank memoranda:

1. A credit of $2,242 for the collection for Bogalusa Company of an electronic funds transfer.

2. A debit for the printing of additional company checks $85.

At November 30, the cash balance per books was $11,073.80 and the cash balance per bank statement was $17,712.50. The bank did not make any errors, but Bogalusa Company made two errors.

Instructions

a. Using the steps in the reconciliation procedure described in the chapter, prepare a bank reconciliation at November 30, 2020.b. Prepare the adjusting entries based on the reconciliation. The correction of any errors pertaining to recording checks should be made to Accounts Payable. The correction of any errors relating to recording cash receipts should be made to Accounts Receivable.

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1119392132

3rd edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso