Two of the largest chains of grocery stores in the United States are Albertsons Inc. and the

Question:

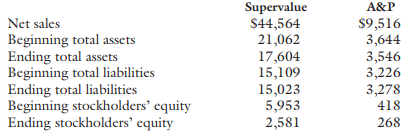

Two of the largest chains of grocery stores in the United States are Albertson’s Inc. and the Great Atlantic & Pacific Tea Company (A&P). Albertson’s is now part of Supervalue, Inc. In fiscal 2008, Supervalue had a net loss of $2,855 million, and A&P had a net loss of $140 million. It is difficult to judge which company is more profitable from those figures alone because they do not take into account the relative sales, sizes, and investments of the companies. Data (in millions) to complete a financial analysis of the two companies follow

1. Determine which company was more profitable by computing profit margin, asset turnover, return on assets, debt to equity ratio, and return on equity for the two companies. Comment on the relative profitability of the two companies.

2. What do the ratios tell you about the factors that go into achieving an adequate return on assets in the grocery industry? For industry data, refer to Figures 4-4 through 4-9 in this chapter.

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson