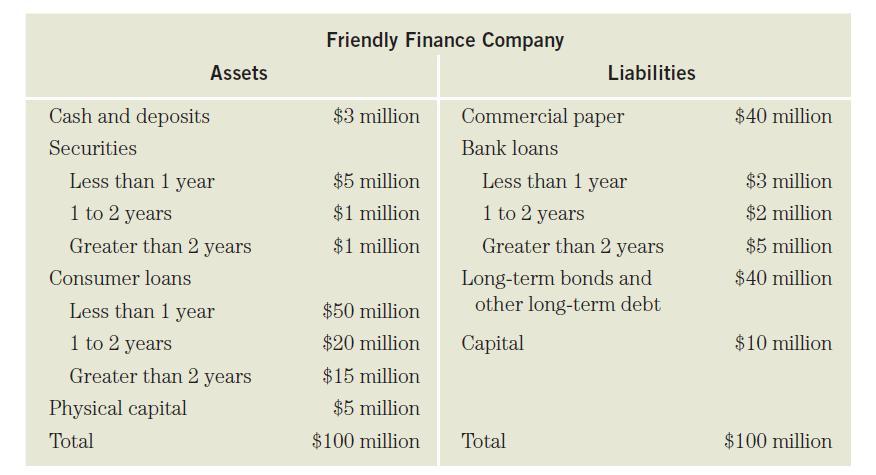

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that

Question:

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that interest rates are initially at 8%.

Given the estimates of duration found in problem 27, how should the Friendly Finance Company alter the duration of its assets to immunize its net worth from interest-rate risk?

Data From Problem 27

If the manager of the Friendly Finance Company revises the estimates of the duration of the company's assets to two years and liabilities to four years, what is the effect on net worth if interest rates rise by 3 percentage points?

Transcribed Image Text:

Cash and deposits Securities Assets Less than 1 year 1 to 2 years Greater than 2 years Consumer loans Less than 1 year 1 to 2 years Greater than 2 years Physical capital Total Friendly Finance Company $3 million $5 million $1 million $1 million $50 million $20 million $15 million $5 million $100 million Liabilities Commercial paper Bank loans Less than 1 year 1 to 2 years Greater than 2 years Long-term bonds and other long-term debt Capital Total $40 million $3 million $2 million $5 million $40 million $10 million $100 million

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

To immunize the net worth of Friendly Finance Company from interestrate risk you need to match the duration of assets with the duration of liabilities ...View the full answer

Answered By

Atuga Nichasius

I am a Highly skilled Online Tutor has a Bachelor’s Degree in Engineering as well as seven years of experience tutoring students in high school, bachelors and post graduate levels. I have a solid understanding of all learning styles as well as using asynchronous online platforms for tutoring needs. I individualise tutoring for students according to content tutoring needs assessments.

My strengths include good understanding of all teaching methods and learning styles and I am able to convey material to students in an easy to understand manner. I can also assists students with homework questions and test preparation strategies and I am able to help students in math, gre, business , and statistics

I consider myself to have excellent interpersonal and assessment skills with strong teaching presentation verbal and written communication

I love tutoring. I love doing it. I find it intrinsically satisfying to see the light come on in a student's eyes.

My first math lesson that I taught was when I was 5. My neighbor, still in diapers, kept skipping 4 when counting from 1 to 10. I worked with him until he could get all 10 numbers in a row, and match them up with his fingers.

My students drastically improve under my tutelage, generally seeing a two grade level improvement (F to C, C to A, for example), and all of them get a much clearer understanding!

I am committed to helping my students get the top grades no matter the cost. I will take extra hours with you, repeat myself a thousand times if I have to and guide you to the best of my ability until you understand the concept that I'm teaching you.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted:

Students also viewed these Business questions

-

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that interest rates are initially at 8%. Given the estimates of duration in problem 27, how should the...

-

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that interest rates are initially at 8%. If the manager of the Friendly Finance Company revises the...

-

Assume that the Friendly Finance Company initially has the balance sheet shown on page 607 and that interest rates are initially at 8%. If the manager of the Friendly Finance Company decides to sell...

-

Matrix squaring. Write a program like Markov that computes page ranks by repeatedly squaring the matrix, thus computing the sequence p, p 2 , p 4 , p 8 , p 16 , and so forth. Verify that all of the...

-

Explain the major difference between statistical and nonstatistical sampling. What are the three main parts of statistical and nonstatistical methods?

-

A branch of a certain bank in New York City has six ATMs. Let X represent the number of machines in use at a particular time of day. The cdf of X is as follows: Calculate the following probabilities...

-

Look at the visualization titled "Changing Face of America" (the second visualization on the page). This is a new kind of visualization in which the total for each year is scaled to $100 %$, and the...

-

A. Fethe Inc. is a custom manufacturer of guitars, mandolins, and oilier stringed instruments that is located near Knoxville, Tennessee. Fethes current value of operations, which is also its value of...

-

imagine this experimental setup: One temperature probe is in embedded in a small block of frozen sugar water at -20. The frozen sugar water is in a small test tube The melting/freezing point of this...

-

If the pension fund Anna manages expects to have an inflow of $240 million 12 months from now, what forward contract should Anna seek to enter into in order to lock in current interest rates?

-

CNDF Bank has assets totaling $250 million with an average duration of 5 years, and liabilities totaling $225 million, with an average duration of 4 years. CNDF Bank is subject to Basel III...

-

What are the two general types of plant layout? Explain each in detail.

-

What challenges, advantages, and disadvantages do teams in multiple countries and geographies face during a company's product development project phase? Are virtual teams versus co-located teams...

-

1. Are risk and uncertainty the same or different? If they are different, explain the differences. 2. What are the four components of Risk Management and define each component. 3. What are the key...

-

Scenario 2. Joe asks his friend Robin to join him in starting the Be You Sailing Corporation, which issued voting common stock with a fair market value of $1,400,000. They each transferred property...

-

I need a summary of the CAPITAL COST ALLOWANCE TAXATION IN CANADA Points to cover the origin, the deductions, computation and methods.

-

How does the concept of servitization contribute to revenue generation and customer satisfaction in business operations?

-

Assume that we have two events, A and B, that are mutually exclusive. Assume further that we know P(A) = .30 and P(B) = .40. a. What is P(A ( B)? b. What is P(A | B)? c. A student in statistics...

-

From 1970 to 1990, Sri Lanka's population grew by approximately 2.2 million persons every five years. The population in 1970 was 12.2 million people.What is the best formula for P, Sri Lanka's...

-

a. Determine the forward rate for various one-year interest rate scenarios if the two-year interest rate is 8 percent, assuming no liquidity premium. Explain the relationship between the one-year...

-

Determine how the after-tax yield from investing in a corporate bond is affected by higher tax rates, holding the before-tax yield constant. Explain the logic of this relationship.

-

a. Determine how the appropriate yield to be offered on a security is affected by a higher risk-free rate. Explain the logic of this relationship. b. Determine how the appropriate yield to be offered...

-

Journalize the nine adjusting entries that the company made on December 3 1 , current year. TINKER CORPORATION TRIAL BALANCES DECEMBER 31, CURRENT YEAR Unadjusted Adjusted Debit Credit Debit Credit...

-

What would be the duration of the zero-coupon bond with 18 months to maturity, face value of $5,000,000, and a yield of 7.55% p.a.?

-

This hasn't completely provided the answer to this question, why did analysing the risk, cost and control help you decide that a bank was the best fit for your choice of finance. Why wouldn't an...

Study smarter with the SolutionInn App