Suppose there are two bonds you are considering: a. If both bonds had a required rate of

Question:

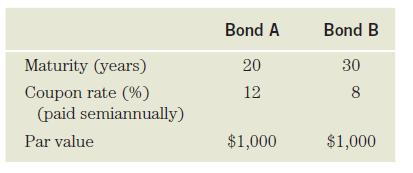

Suppose there are two bonds you are considering:

a. If both bonds had a required rate of return of 10%, what would the bonds' prices be?

b. Explain what it means when a bond is selling at a discount, a premium, or at its face amount (par value). Based on results in part (a), would you consider both bonds to be selling at a discount, premium, or at par?

c. Re-calculate the prices of the bonds if the required return falls to 9%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Institutions

ISBN: 9781292215006

9th Global Edition

Authors: Stanley Eakins Frederic Mishkin

Question Posted: