A friend of ours needs to borrow money, say, ($ 10,000). He will give that money back

Question:

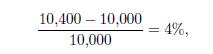

A friend of ours needs to borrow money, say, \(\$ 10,000\). He will give that money back in one year, and to compensate us for our help, he will top \(\$ 400\) on it. Should we accept his proposal? Of course, we might do so just because he is a very dear friend of ours, but let us analyze the situation rationally as an investment analysis problem. Analyzing an investment requires some sort of relative comparison between comparable alternatives. Hence, let us say that our bank offers an interest rate of \(3 \%\) for a deposit of one year. This means that if we lend our money to the bank, we will receive \(\$ 10,300\) in one year, which is less than the \(\$ 10,400\) offered by our friend. Another way to compare the two alternatives is to consider the return on the loan,

a return larger than the \(3 \%\) offered by the bank. Thus, it would seem that we might be better off by lending to our friend.

Actually, comparing the two proposals may not be so trivial. We should also consider the possibility of not getting the money back at all, if a default occurs. Arguably, the bank should be financially more reliable than our friend, so the two interest rates might not be quite comparable, and we need a way to bring risk into the picture. Furthermore, taxes and more or less hidden fees or transaction costs may play a role as well. In this chapter, we do not consider additional complications like market frictions or uncertainty in cash flows, due to default and other risk factors. We assume that the interest rates that we analyze are, in a sense to be made clear, risk-free. Last but not least, in this simple example, we are comparing two opportunities resulting in cash flows that do not differ in their timing. What if we have to compare sequences of cash flows occurring at different times?

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte