For the corporate bond issues reported in question 12, answer the following questions: a. What is the

Question:

For the corporate bond issues reported in question 12, answer the following questions:

a. What is the yield spread between the Southern Bell Telephone and Telegraph bond issue and the Bell Telephone Company (Pennsylvania) bond issue?

b. The Southern Bell Telephone and Telegraph bond issue is not callable but the Bell Telephone Company (Pennsylvania) bond issue is callable. What does the yield spread in (a) reflect?

c. AMIR Corporation is the parent company of American Airlines and is therefore classified in the transportation industry. The bond issue cited is not callabie. What is the yield spread between the AMR Corporation and Southern Bell Telephone and Telegraph bond issue, and what does this spread reflect?

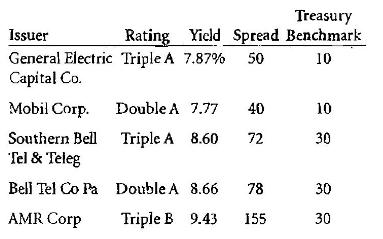

Data from Question 12

In the May 29, 1992, Weekly Market Update, published by Goldman Sachs \& Co., the following information was reported in various exhibits for certain corporate bonds as of the close of business Thursday, May 28, 1992:

Step by Step Answer:

Foundations Of Financial Markets And Institutions

ISBN: 9780136135319

4th Edition

Authors: Frank J Fabozzi, Franco G Modigliani, Frank J Jones