Question: Let us consider an array of continuously compounded spot interest rates for time periods of one year: Say that no increase is expected and If

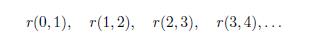

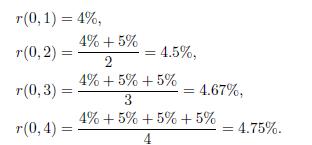

Let us consider an array of continuously compounded spot interest rates for time periods of one year:

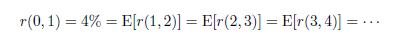

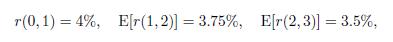

Say that no increase is expected and

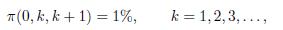

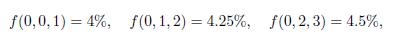

If the risk premium is

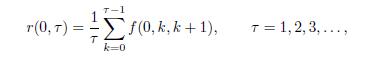

Then, the term structure is an average of forward rates,

which in this specific case yields

Thus, we observe an increasing term structure, even though there is no expected increase in the spot rates.

It may even happen that an increasing term structure results from decreasing expected spot rates, if the liquidity premium is increasing. For instance, let us consider

and

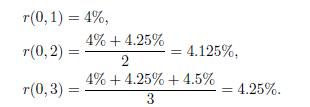

Then, in this case, we find

and

The resulting term structure is increasing, even though rates are expected to drop.

r(0,1), (1,2), r(2,3), (3,4),...

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts