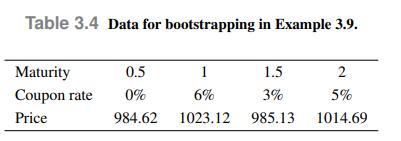

Let us consider the bond prices of Table 3.4, where we assume that all face values are

Question:

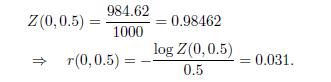

Let us consider the bond prices of Table 3.4, where we assume that all face values are 1000 and coupons are semiannual, and find the implied continuously compounded rates. The price of the first zero maturing in six months yields the first discount factor immediately:

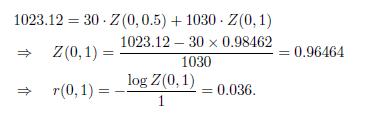

The second bond has two cash flows, 30 and 1030, in six months and one year, respectively. Hence

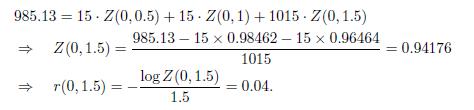

By a similar token,

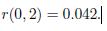

The last step yields

Data From Table 3.4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: