Say that the current price of a stock share of Boom Corp is ($ 100), and we

Question:

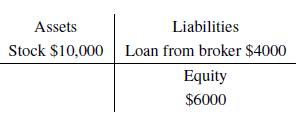

Say that the current price of a stock share of Boom Corp is \(\$ 100\), and we buy 100 shares, for a total amount of \(\$ 10,000\). To finance the trade, we borrow \(\$ 4,000\) from the broker. The initial situation is as follows:

The initial margin ratio is

\[\frac{\text { Equity }}{\text { Assets }}=\frac{\$ 6000}{\$ 10000}=60 \%\]

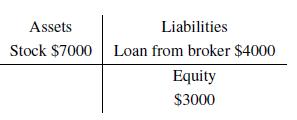

and let us assume that the maintenance margin ratio is 30\%. Note that, for the sake of simplicity, we are not considering the interest payment to the broker. If things turn sour and the stock price falls to \(\$ 70\) per share, the new balance sheet will be

and the margin ratio now is just

\[\frac{\$ 3000}{\$ 7000}=43 \%\]

A natural question is: How far can a stock price fall before getting a margin call? If we let \(P\) be price of the stock, the margin ratio is \[\frac{100 P \quad \$ 4000}{100 P}\]

The limit price is obtained by setting this ratio to \(30 \%\) and solving for \(P\), which yields \(P_{\lim }=\$ 5714\).

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte