Suppose that we will have to buy one unit of an asset in 1 year. To hedge

Question:

Suppose that we will have to buy one unit of an asset in 1 year. To hedge risk, we go long one futures contract at price \(\$ 100\), which will be settled in cash at maturity. Note that, with a forward contract, we would lock a price of to be paid in one year, with a single cash flow, resulting in a perfect hedge. However, a futures contract is marked to market each day.

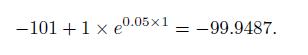

Assume that, at the end of the first day, at settlement, the futures price drops to \(\$ 99\) and then stays constant until maturity. Then, we incur a loss of \(\$ 1\) on day 1 , which is financed by borrowing \(\$ 1\) at a continuously compounded rate of, say, \(5 \%\) per year. After day 1 , no additional cash flow will occur due to marking-to-market. At maturity, we will buy the asset at \(\$ 99\) on the spot market, and the overall cash flow stream is equivalent to a negative cash flow of

![]()

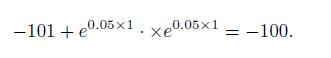

This is a bit of bad news, as the total cost turns out to be more than anticipated. By a similar token, let us assume that, at the settlement on the first day, the futures price rises to \(\$ 101\) and then stays constant. In this case, we have an immediate profit of \(\$ 1\), which may be invested for one year. Again, no additional cash flow occurs, due to markingto-market, and the equivalent cash flow at maturity is

In this case, we receive good news, but the point is that the hedge is not perfect.

Essentially, we are over-hedging, and we should reduce the initial hedge by a factor  . In other words, rather than buying one futures contract, we should buy

. In other words, rather than buying one futures contract, we should buy

![]()

contracts. In the two scenarios, the equivalent cash flow at maturity would be the same:

![]()

and

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte