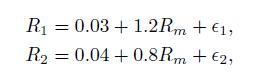

The annual returns of two stock shares are represented by the following linear factor model: where the

Question:

The annual returns of two stock shares are represented by the following linear factor model:

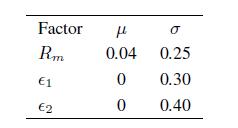

where the common factor \(R_{m}\) represents a systematic market risk (e.g., the return on a stock market index), and ϵ1 and ϵ2 are specific risk factors. We assume that all of the risk factors are uncorrelated and normally distributed with the following parameters (expected value and standard deviation):

You have invested \(40 \%\) of your wealth in the first asset and \(60 \%\) in the second one. Find the probability that the realized annual return is negative, i.e., you lose money.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: