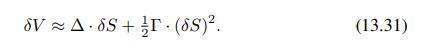

The approximation of Eq. (13.31) is sometimes suggested as a possible way to approximate V@R of option

Question:

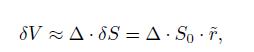

The approximation of Eq. (13.31) is sometimes suggested as a possible way to approximate V@R of option portfolios. For instance, with the data of Example 13.10, we may apply the following first-order approximation:

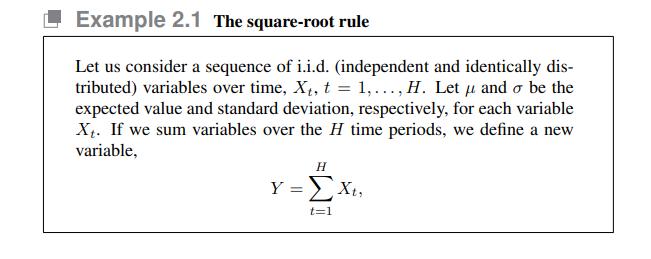

where we link the change in the portfolio value, \(V\), with the random return on the stock share, \(r=S S_{0}\). Say that we need the \(99 \%\) daily \(\mathrm{V} @ \mathrm{R}\). If we assume that the stock return is normally distributed, we find

![]()

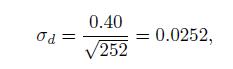

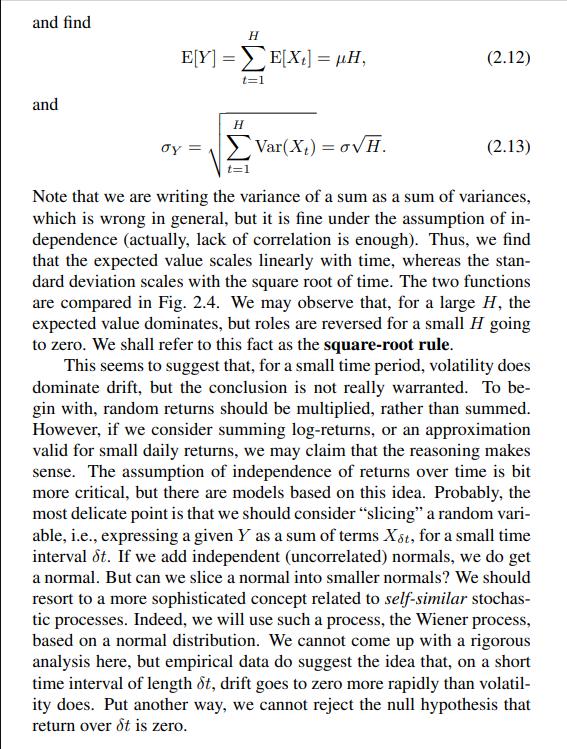

where \(\quad d\) is the daily volatility of the stock share price. This may be estimated by scaling the annual volatility as follows:

where we use the square-root rule introduced in Example 2.1. The square-root rule is also the reason why we do not consider the stock share daily drift. Note that, to scale annual volatility down to daily volatility, we use 252 , which is roughly the number of trading days in one year. Hence,

![]()

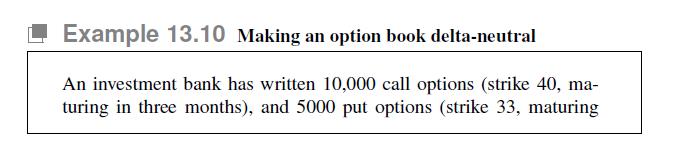

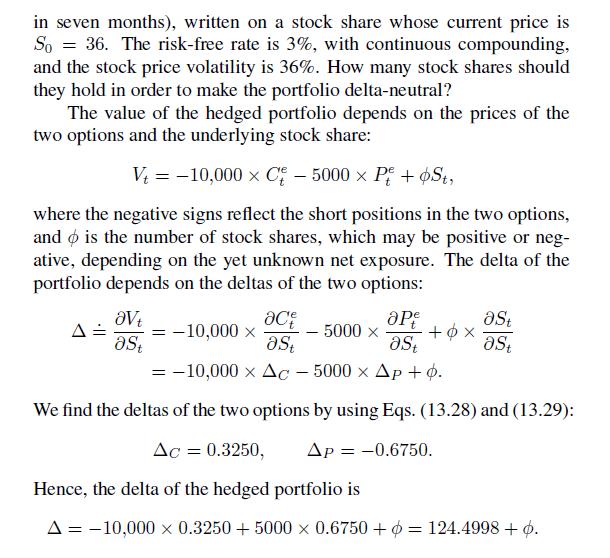

Data From Example 13.10

Data From Equation (13.31)

Data From Example 2.1

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte