Black Company, organized on January 2, 2008, had pre-tax accounting income of ($500,000) and taxable income of

Question:

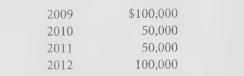

Black Company, organized on January 2, 2008, had pre-tax accounting income of \($500,000\) and taxable income of \($800,000\) for the year ended December 31, 2008. The only temporary difference is accrued product warranty costs, which are expected to be paid as follows:

Circumstances indicate that it is highly likely that Black will have taxable income in the future.

It had no temporary differences in prior years. The enacted income tax rates are 35% for 2008, 30% for 2009 through 2011, and 25% for 2012.

Required:

In Black’s December 31, 2008 balance sheet, how much should the deferred income tax asset be?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: