Question: The following table reports the operating cycle, cash conversion cycle, and current ratio for three retailers in the apparel business. The GAP built its brand

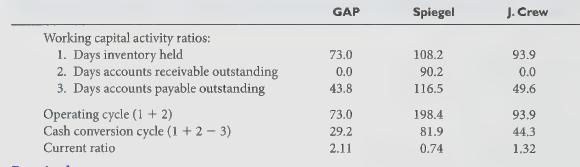

The following table reports the operating cycle, cash conversion cycle, and current ratio for three retailers in the apparel business. The GAP built its brand name on basic, casual clothing styles (T-shirts, jeans, and khakis). Over the years, the company expanded by opening Banana Republic and Old Navy stores. Spiegel is a top U.S. direct retailer, selling through its namesake catalog and its Eddie Bauer unit. The majority of J. Crew's sales come from classic-styled jeans, khakis, and other basic items sold to young professionals through catalogs, a Web site, and the company's retail and factory outlets.

Required:

1. Do any of these companies appear to have a short-term liquidity problem?

2. Which company has the most mismatched cash flow?

3. All three companies are in the same industry. Why is Spiegel the only one with accounts receivable?

GAP Spiegel J.Crew Working capital activity ratios: 1. Days inventory held 73.0 108.2 93.9 2. Days accounts receivable outstanding 0.0 90.2 0.0 3. Days accounts payable outstanding 43.8 116.5 49.6 Operating cycle (1 + 2) 73.0 198.4 93.9 Cash conversion cycle (1 + 2 - 3) 29.2 81.9 44.3 Current ratio 2.11 0.74 1.32

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts