1. How does the trend in Enrons operating income compare with the trend in its income after...

Question:

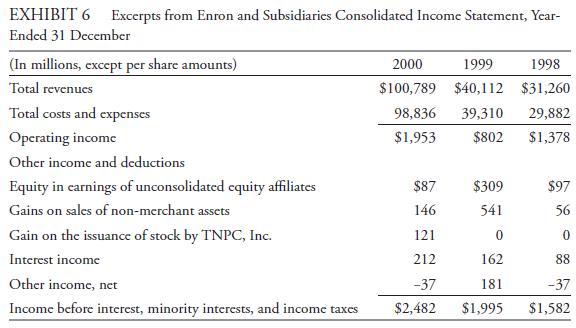

1. How does the trend in Enron’s operating income compare with the trend in its income after other income and deductions (i.e., Income before interest, minority interests, and income taxes)?

2. What items appear to be non-recurring as opposed to being a result of routine operations?

How significant are these items?

3. The Enron testimony of short seller James Chanos before US Congress referred to “a number of one-time gains that boosted Enron’s earnings” as one of the items that “strengthened our conviction that the market was mispricing Enron’s stock” (Chanos 2002). What does Chanos’s statement indicate about how Enron’s earnings information was being used in valuation?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie