A credit analyst is evaluating and comparing the solvency of two companiesNokia Corporation (NYSE: NOK) and LM

Question:

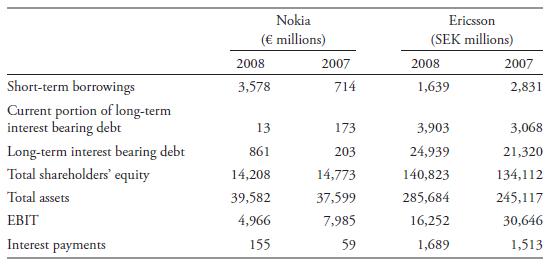

A credit analyst is evaluating and comparing the solvency of two companies—Nokia Corporation (NYSE: NOK) and LM Ericsson Telephone Company (NYSE: ERIC)—

at the beginning of 2009. The following data are gathered from the companies’ 2008 annual reports and 20-F filings:

Use the above information to answer the following questions:

1.

A. What are each company’s debt-to-assets, debt-to-capital, and debt-to-equity ratios for 2008 and 2007?

B. Comment on any changes in the calculated leverage ratios from year-to-year for both companies.

C. Comment on the calculated leverage ratios of Nokia compared to Ericsson.

2.

A. What is each company’s interest coverage ratio for 2008 and 2007?

B. Comment on any changes in the interest coverage ratio from year to year for both companies.

C. Comment on the interest coverage ratio of Nokia compared to Ericsson.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie