Ahmad Nazri, the CEO of 1MDB Inc., has a proposal to present to his board of directors

Question:

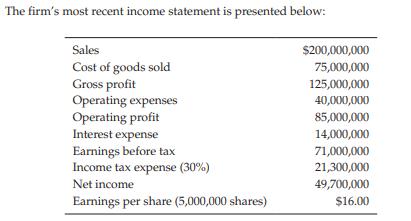

Ahmad Nazri, the CEO of 1MDB Inc., has a proposal to present to his board of directors pertaining to a power plant expansion that will cost $50 million. He is, however, unsure whether the planned expansion should be financed via a debt issue (a long-term note from the SBC Bank with an interest of 25%) or through the issuance of common stock

(2,500,000 shares at $20 per share).

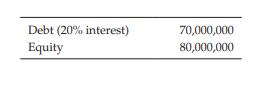

1MDB Inc. currently has a capital structure of:

Due to the uncertainties surrounding the firm, he is aware that expansion through a debt issuance will increase the riskiness of the firm. However, at the same time, it could also benefit shareholders through the financial leverage effect. The estimates are that the plant expansion will increase operating profit by 30%. The tax rate is expected to remain stable at 30%. 1MDB Inc. has a 100% dividend payout ratio policy.

Required:

(a) Calculate the debt ratio, times interest earned ratio, earnings per share, and the financial leverage index under each alternative, assuming the expected increase in operating profit is realized.

(b) Discuss the factors the board should consider in making a decision.

Step by Step Answer:

Understanding Financial Statements

ISBN: 9781292101552

11th Global Edition

Authors: Lyn Fraser, Aileen M. Ormiston