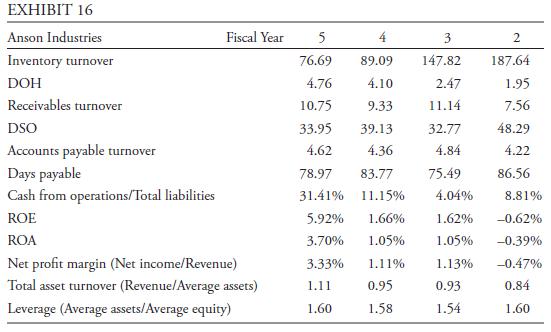

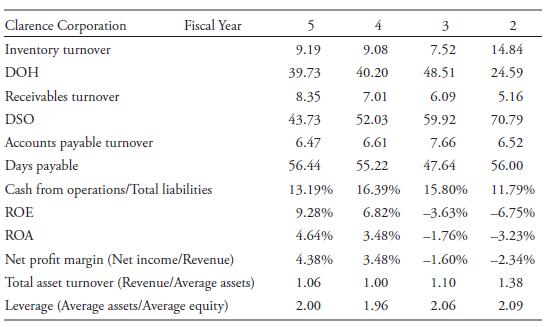

Question: An analyst collects the information shown in Exhibit 16 for two companies: Which of the following choices best describes reasonable conclusions an analyst might make

An analyst collects the information shown in Exhibit 16 for two companies:

Which of the following choices best describes reasonable conclusions an analyst might make about the companies’ efficiency?

A. Over the past four years, Anson has shown greater improvement in efficiency than Clarence, as indicated by its total asset turnover ratio increasing from 0.84 to 1.11.

B. In FY5, Anson’s DOH of only 4.76 indicated that it was less efficient at inventory management than Clarence, which had DOH of 39.73.

C. In FY5, Clarence’s receivables turnover of 8.35 times indicated that it was more efficient at receivables management than Anson, which had receivables turnover of 10.75.

EXHIBIT 16 Anson Industries Inventory turnover DOH Receivables turnover Fiscal Year DSO Accounts payable turnover Days payable Cash from operations/Total liabilities ROE ROA Net profit margin (Net income/Revenue) Total asset turnover (Revenue/Average assets) Leverage (Average assets/Average equity) 5 76.69 4.76 10.75 4 89.09 4.10 9.33 33.95 39.13 4.62 4.36 78.97 83.77 31.41% 11.15% 5.92% 1.66% 3.70% 1.05% 3.33% 1.11% 1.11 0.95 1.60 1.58 3 147.82 2.47 11.14 32.77 4.84 75.49 4.04% 1.62% 1.05% 2 187.64 1.95 7.56 48.29 4.22 86.56 8.81% -0.62% -0.39% 1.13% -0.47% 0.93 0.84 1.54 1.60

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

A is correct Over the past four years Anson has shown greater improveme... View full answer

Get step-by-step solutions from verified subject matter experts