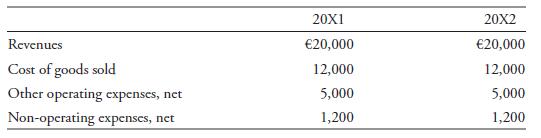

Assume that FinnCo had the following income statement information in both 20X1 and 20X2, excluding a foreign

Question:

Assume that FinnCo had the following income statement information in both 20X1 and 20X2, excluding a foreign currency transaction gain of €200 in 20X1 and a transaction loss of €50 in 20X2.

FinnCo is deciding between two alternatives for the treatment of foreign currency transaction gains and losses. Alternative 1 calls for the reporting of foreign currency transaction gains/losses as part of “Other operating expenses, net.” Under Alternative 2, the company would report this information as part of “Non-operating expenses, net.”

FinnCo’s fiscal year end is 31 December. How will Alternatives 1 and 2 affect the company’s gross profit margin, operating profit margin, and net profit margin for 20X1? For 20X2?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie