In this example, two fictitious companies are used. On 1 January 2011, Baxter Inc. invested 300,000 in

Question:

In this example, two fictitious companies are used. On 1 January 2011, Baxter Inc. invested £300,000 in Cartel Co. debt securities (with a 6% stated rate on par value, payable each 31 December). The par value of the securities was £275,000. On 31 December 2011, the fair value of Baxter’s investment in Cartel is £350,000.

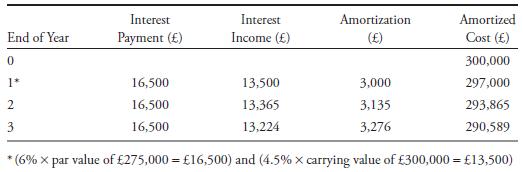

Assume that the market interest rate in effect when the bonds were purchased was 4.5%. If the investment is designated as held-to-maturity, the investment is reported at amortized cost using the effective interest method. A portion of the amortization table is as follows:

1. How would this investment be reported on the balance sheet, income statement, and statement of shareholders’ equity at 31 December 2011, under either IFRS or US GAAP (accounting is essentially the same in this case), if Baxter designated the investment as 1) held-to-maturity, 2) held for trading, 3) available-for-sale, or 4)

1. How would this investment be reported on the balance sheet, income statement, and statement of shareholders’ equity at 31 December 2011, under either IFRS or US GAAP (accounting is essentially the same in this case), if Baxter designated the investment as 1) held-to-maturity, 2) held for trading, 3) available-for-sale, or 4)

designated at fair value?

2. How would the gain be recognized if the debt securities were sold on 1 January 2012 for £352,000?

3. How would this investment appear on the balance sheet at 31 December 2012?

4. How would the classification and reporting differ if Baxter had invested in Cartel’s equity securities instead of its debt securities?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie