The following are excerpts from Note 14 (Income Taxes) to the 2020 Consolidated Financial Statements of Coca-Cola

Question:

The following are excerpts from Note 14 (Income Taxes) to the 2020 Consolidated Financial Statements of Coca-Cola Company (Coca-Cola):

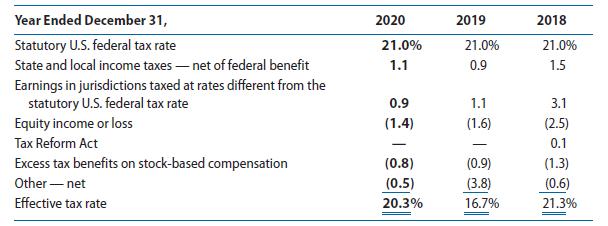

A reconciliation of the statutory U.S. federal tax rate and our effective tax rate is as follows:

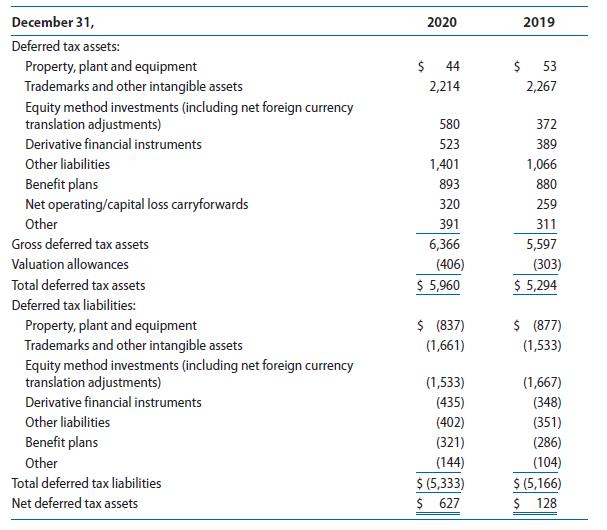

The tax effects of temporary differences and carryforwards that give rise to deferred tax assets and liabilities consisted of the following (in millions):

REQUIRED

a. Does Coca-Cola receive a tax benefit from earning income in non-U.S. jurisdictions?

b. Is it likely that Coca-Cola has recognized a net asset or a net liability on its balance sheet for pension and other postretirement benefit plans? Explain your reasoning.

c. Coca-Cola discloses that the valuation allowance on deferred tax assets relates primarily to net operating loss carryforwards. Assume for purposes of this question that Coca-Cola had recognized a valuation allowance each year exactly equal to the deferred tax assets recognized for net operating loss carryforwards. Indicate the effect on income tax expense and income tax payable in the year Coca-Cola initially recognizes the net operating loss carryforwards.

d. Refer to Requirement c. Indicate the effect on income tax expense and income tax payable in the year Coca-Cola benefits from the net operating loss carryforwards.

e. Interpret Coca-Cola’s recognition of net deferred tax liabilities, instead of deferred tax assets, for equity investments in 2020.

f. Why does Coca-Cola report tax effects of equity income and investments in the income tax reconciliation and in deferred tax liabilities?

g. Interpret Coca-Cola’s recognition of deferred tax assets, instead of deferred tax liabilities, for intangible assets.

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation

ISBN: 9780357722091

10th Edition

Authors: James M Wahlen, Stephen P Baginskl, Mark T Bradshaw