The following are excerpts from Notes 2 and 13 of Sony Corporations (NYSE: SNE) 20-F filing for

Question:

The following are excerpts from Notes 2 and 13 of Sony Corporation’s (NYSE: SNE) 20-F filing for the fiscal year ended 31 March 2009. These discuss the option for reporting fair values in the balance sheet and illustrate financial statement disclosures of fair values.

Excerpt from Note 2: Summary of significant accounting policies

. . . “The Fair Value Option for Financial Assets and Financial Liabilities.”

. . . permits companies to choose to measure, on an instrument-by-instrument basis, various financial instruments and certain other items at fair value that are not currently required to be measured at fair value. The fair value measurement election is irrevocable and subsequent changes in fair value must be recorded in earnings. . . . Sony did not elect the fair value option for any assets or liabilities that were not previously carried at fair value.

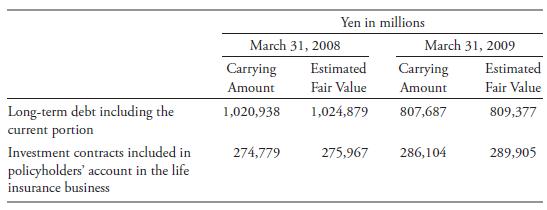

Excerpt from Note 13: Fair value measurements The estimated fair values of Sony’s financial instruments are summarised as follows. The following summary excludes cash and cash equivalents, call loans, time deposits, notes and accounts receivable, trade, call money, short-term borrowings, notes and accounts payable, trade and deposits from customers in the banking business because the carrying values of these financial instruments approximated their fair values due to their short-term nature.

The fair values of long-term debt including the current portion and investment contracts included in policyholders’ account in the life insurance business were estimated based on either the market value or the discounted future cash flows using Sony’s current incremental borrowing rates for similar liabilities.

Use the excerpts from the notes to Sony’s financial statements to address the following questions:

1. Does Sony report the fair values of its long-term debt on the balance sheet?

2. How does Sony measure the long-term debt reported on the balance sheet?

3. As of 31 March 2008 and 31 March 2009, what is the percent difference in the carrying amount and fair value of Sony’s long-term debt

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie