Question: Easy Access, an internet services provider, acquired Visible, an eye-tracking software development company, for US$3.75 billion. At the date of acquisition, it recognised three amortisable

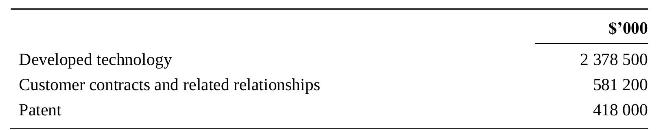

Easy Access, an internet services provider, acquired Visible, an eye-tracking software development company, for US\$3.75 billion. At the date of acquisition, it recognised three amortisable intangible assets, namely:

These intangible assets were acquired as part of a business combination.

Required Discuss the accounting for intangible assets acquired in a business combination and how it differs from the recognition and measurement of other intangible assets.

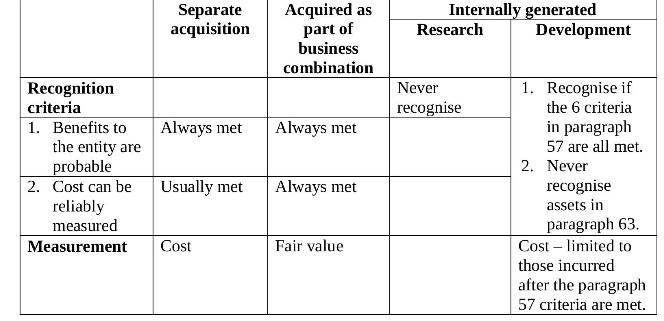

Recognization Before assets are recognised in the accounting records they must meet asset recognition criteria. There are normally two recognition criteria for assets, namely (i) the expected future economic benefits are probable and (ii) the cost can be reliably measured.

Paragraph 33 of AASB 138/IAS 38 states that in a business combination, the effect of probability of the existence of future economic benefits is reflected in the measurement of the asset at fair value, hence any probability recognition criteria is automatically met.

Paragraph 33 of AASB 138/IAS 38 also states that the reliability of measurement recognition test is always met as sufficient information is always available in a business combination to reliably measure intangible assets.

As per the table above, with a business combination, there are effectively no recognition criteria for intangible assets as they are always considered to be met.

Measurement For intangible assets, the general measurement rule is measurement at cost. However with intangible assets acquired in a business combination cost is measured at fair value, measured in accordance with AASB 13.

Provided the intangible assets meet the definition of an asset, they must be recognised as separate assets.

Note in particular the asset "Developed technology": it may be possible that Visible had expensed all development outlays as the criteria in paragraph 57 of AASB 138/IAS 38 had not been met. However in a business combination, development becomes an acquired asset in contrast to an internally developed asset. Easy Access will recognise any development asset that exists and not also that, it does not have to consider the costs that had been incurred by Easy Access in relation to development as Easy Access will measure this asset at fair value.

Developed technology Customer contracts and related relationships Patent $'000 2 378 500 581 200 418 000

Step by Step Solution

3.32 Rating (140 Votes )

There are 3 Steps involved in it

Recognising intangible assets The Global Alliance 2013 provided the following statement in a press r... View full answer

Get step-by-step solutions from verified subject matter experts