Question: Exhibit 4.22 presents selected operating data for three retailers for a recent year. Macy??s operates several department store chains selling consumer products such as brand-name

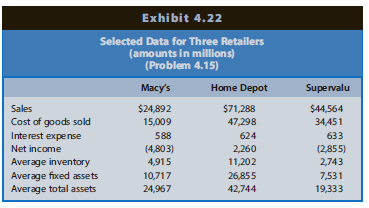

Exhibit 4.22 presents selected operating data for three retailers for a recent year. Macy??s operates several department store chains selling consumer products such as brand-name clothing, china, cosmetics, and bedding and has a large presence in the bridal and formalwear markets (under store names Macy??s and Bloomingdale??s). Home Depot sells a wide range of building materials and home improvement products, which includes lumber and tools, riding lawn mowers, lighting fixtures, and kitchen cabinets and appliances. Supervalu operates grocery stores under numerous brands (including Albertsons, Cub Foods, Jewel-Osco, Shaw??s, and Star Market).

REQUIREDa. Compute the rate of ROA for each firm. Disaggregate the rate of ROA into profit margin for ROA and assets turnover components. Assume that the income tax rate is 35% for all companies.b. Based on your knowledge of the three retail stores and their respective industry concentrations, describe the likely reasons for the differences in the profit margins for ROA and assets turnovers.

Exhibit 4.22 Selected Data for Three Retailers (amounts in millions) (Problem 4.15) Macy's Home Depot Supervalu Sales $24,892 $71,288 $44,564 Cost of goods sold 15,009 47,298 34,451 Interest expense 588 624 633 2,260 11,202 Net income (4,803) (2,855) Average inventory 4,915 2,743 Average fixed assets 10,717 26,855 7,531 Average total assets 24,967 42,744 19,333

Step by Step Solution

3.53 Rating (170 Votes )

There are 3 Steps involved in it

a The following additional ratios help in interpreting the profit margin for ROA and assets turnover of these companies b Macys performed poorly reporting a large net loss It also has the slowest asse... View full answer

Get step-by-step solutions from verified subject matter experts