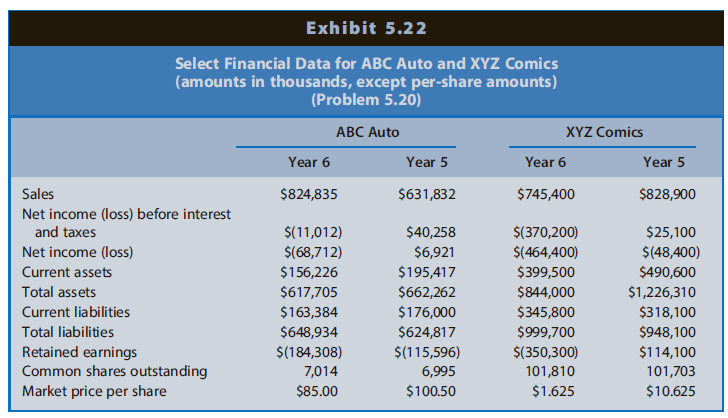

Question: Exhibit 5.22 presents selected financial data for ABC Auto and XYZ Comics for fiscal Year 5 and Year 6. ABC Auto manufactures automobile components that

REQUIRED

a. Compute Altman€™s Z-score for ABC Auto and XYZ Comics for fiscal Year 5 and Year 6.

b. How did the bankruptcy risk of ABC Auto change between fiscal Year 5 and Year 6? Explain.

c. How did the bankruptcy risk of XYZ Comics change between Year 5 and Year 6? Explain.

d. Which firm is more likely to file for bankruptcy during fiscal Year 7? Explain using the analyses from Requirement b.

Exhibit 5.22 Select Financial Data for ABC Auto and XYZ Comics (amounts in thousands, except per-share amounts) (Problem 5.20) XYZ Comics ABC Auto Year 5 Year 6 Year 5 Year 6 Sales $824,835 $631,832 $745,400 $828,900 Net income (loss) before interest and taxes $(11,012) $40,258 $(370,200) $25,100 Net income (loss) $(68,712) $6,921 $(464,400) $(48,400) Current assets $156,226 $195,417 $399,500 $490,600 Total assets $617,705 $662,262 $176,000 $844,000 $1,226,310 Current liabilities $163,384 $345,800 $318,100 Total liabilities $648,934 $624,817 $999,700 $948,100 Retained earnings Common shares outstanding Market price per share $(184,308) $(115,596) $(350,300) $114,100 7,014 6,995 101,810 101,703 $100.50 $85.00 $1.625 $10.625

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

a Altmans ZScore for ABC Auto Altmans ZScore for XYZ Comics b The Zscores for ABC Auto were in the range indicating a high probability of bankruptcy i... View full answer

Get step-by-step solutions from verified subject matter experts