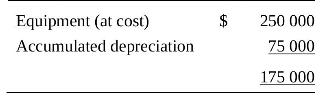

In the 30 June 2023 annual report of Emu Ltd, the equipment was reported as follows: The

Question:

In the 30 June 2023 annual report of Emu Ltd, the equipment was reported as follows:

The equipment consisted of two machines, Machine A and Machine B. Machine A had cost \(\$ 75000\) and had a carrying amount of \(\$ 45000\) at 30 June 2023. Machine B had cost \(\$ 50000\) and had a carrying amount of \(\$ 42500\). Both machines are measured using the cost model and depreciated on a straight-line basis over a 10 -year period.

On 31 December 2023, the directors of Emu Ltd decided to change the basis of measuring the equipment from the cost model to the revaluation model. Machine A was revalued to \(\$ 45000\) with an expected useful life of 6 years, and Machine B was revalued to \$38 750 with an expected useful life of 5 years.

At 1 July 2024, Machine A was assessed to have a fair value of \(\$ 40750\) with an expected useful life of 5 years, and Machine B's fair value was \$34 125 with an expected useful life of 4 years.

Required 1. Prepare journal entries to record depreciation during the year ended 30 June 2024, assuming there was no revaluation.

2. Prepare the journal entries for Machine A for the period 1 July 2023 to 30 June 2024 on the basis that it was revalued on 31 December 2023.

3. Prepare the journal entries for Machine B for the period 1 July 2023 to 30 June 2024 on the basis that it was revalued on 31 December 2023.

4. Prepare the revaluation journal entries required for 1 July 2024.

5. According to accounting standards, on what basis may management change the method of asset measurement, for example from cost to fair value?

Step by Step Answer:

Financial Reporting

ISBN: 9780730396413

4th Edition

Authors: Janice Loftus, Ken Leo, Sorin Daniliuc, Belinda Luke, Hong Nee Ang, Mike Bradbury, Dean Hanlon, Noel Boys, Karyn Byrnes