Kelly Services (Kelly) places employees at clients' businesses on a temporary basis. It segments its services into

Question:

The temporary personnel business offers clients flexibility in adjusting the number of workers to meet changing capacity needs. Temporary employees are typically less costly than permanent workers because they have fewer fringe benefits. However, temporary workers generally are not as well trained as permanent workers and have less loyalty to clients.

Barriers to entry in the personnel supply business are low. This business does not require capital for physical facilities (most space is rented), does not need specialized assets (most temporary employees do not possess unique skills; needed data processing technology is readily available), and operates with little government regulation. Thus, competition is intense and margins tend to be thin.

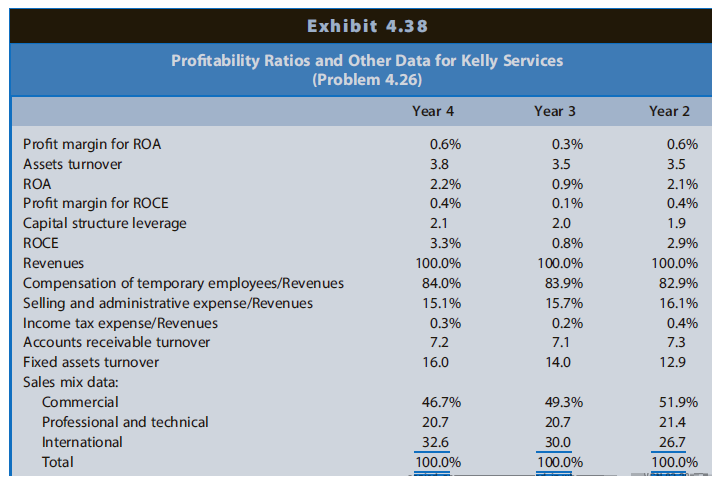

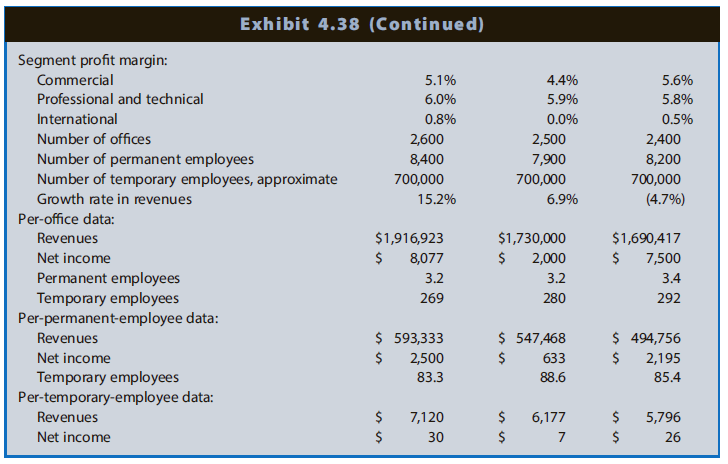

Exhibit 4.38 presents selected profitability ratios and other data for Kelly Services, the largest temporary personnel supply firm in the United States. Note that the data in Exhibit 4.38 reflect the capitalization of operating leases in property, plant, and equipment and long-term debt, a topic discussed in Chapter 6.

REQUIRED

Analyze the changes in the profitability of Kelly Services during the three-year period in as much depth as permitted by the data provided.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Question Posted: