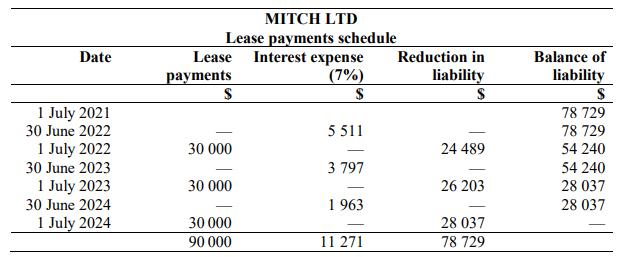

Mitch Ltd prepares the following lease payments schedule for the lease of a machine from Stark Ltd.

Question:

Mitch Ltd prepares the following lease payments schedule for the lease of a machine from Stark Ltd. The machine has an economic life of 6 years. The lease agreement commences at 1 July 2021 and requires four annual payments of \($33\) 000. The machine will be returned to Stark Ltd at the end of the lease term on 30 June 2025. Mitch Ltd did not incur any initial direct costs to set up the lease.

Required The following three multiple-choice questions relate to the information provided above.

Select the correct answer and show any workings required.

1. For the year ended 30 June 2022, what would Mitch Ltd record in relation to the lease?

(a) An interest expense of \($0 (b)\) An interest expense of \($11\) 271

(c) An interest expense of \($5\) 511

(d) An interest expense of \($5\) 760

(e) pense would Mitch Ltd record?

Cannot determine based

2. How much annual depreciation ex on the information provided

(a) \($27\) 182

(b) \($30\) 000

(c) \($13\) 122

3. If on 1 July 2021 Stark Ltd records a lease receivable of \($112\) 327, the difference between this receivable and the liability of \($78\) 729 recorded by Mitch Ltd could be due to what?

(a) A residual value guarantee

(b) An unguaranteed residual value

(c) Both of the above, among others

(d) Neither of the above

Step by Step Answer:

Financial Reporting

ISBN: 9780730396413

4th Edition

Authors: Janice Loftus, Ken Leo, Sorin Daniliuc, Belinda Luke, Hong Nee Ang, Mike Bradbury, Dean Hanlon, Noel Boys, Karyn Byrnes